Submitted by Taps Coogan on the 29th of October 2019 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

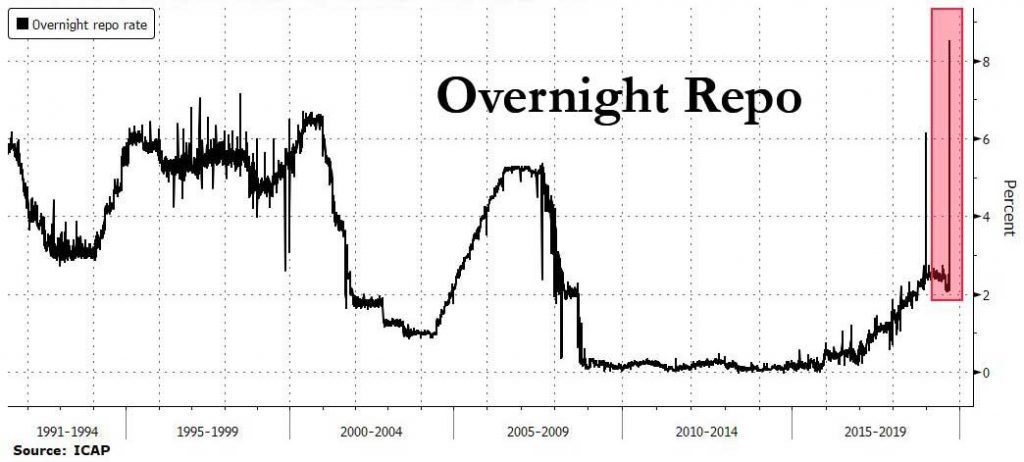

As the market awaits tomorrow’s Fed interest rate decision, it is worthwhile to recall what happened the day before the Fed’s last rate cut: the Fed Funds repo market exploded with overnight rates surging to nearly 10%, their highest in nearly 30 years.

It is not a coincidence that the wild overshoots in the Fed Funds market started on the eve of the Fed’s last rate cut.

Market participants decide to lend their money into the various short term markets based on their own economic interest to make money. To the extent that regulations permit, banks, money market funds, primary dealers, etc… will move money between overnight repo lending (the Fed Funds market), short term treasuries, the Fed itself (to collect the Fed’s excess reserve rate), and other short term markets in order to collect the highest return on their capital.

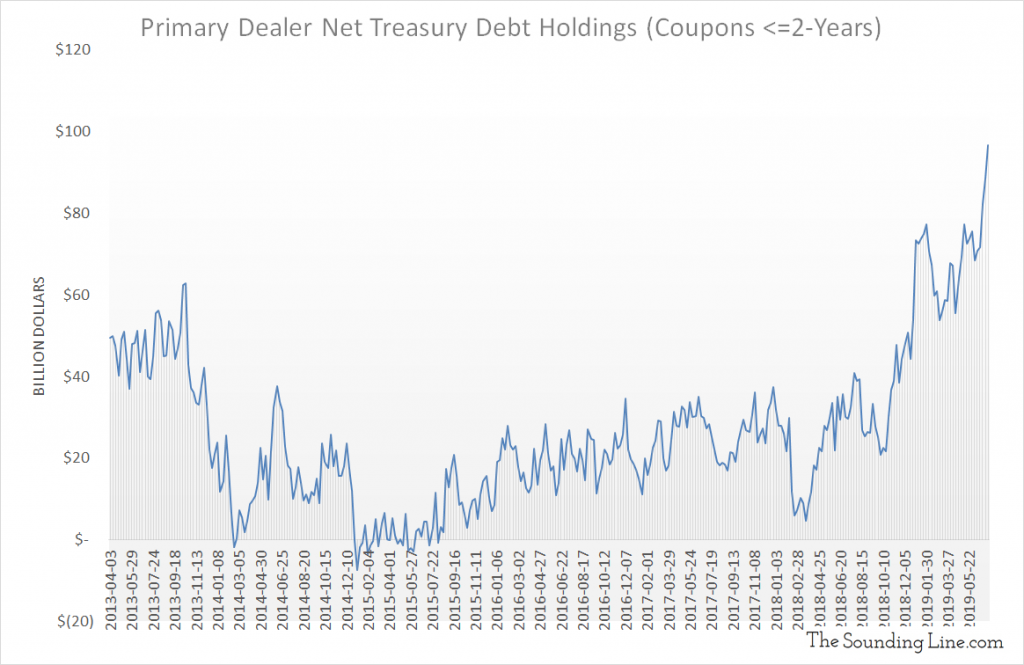

In the months leading up to the August and September rate cuts, financial institutions moved huge amounts of capital into short term treasury markets in order to take advantage of their relatively attractive rates. As we noted in July, primary dealer holdings of short term treasuries were surging to all time record highs. After all, why wouldn’t such institutions take advantage of securing higher rates in the short term treasury market, particularly when the odds of lower rates in the overnight repo market kept rising?

When the Fed lowered rates in September, they simply reduced the economic incentive for institutions to lend into the overnight repo market. Because the Fed was not doing QE nor providing a standing repo facility at the time, they did not simultaneously increase the supply of liquidity. What happens when the government cuts a price below its true economic level and doesn’t supplement supply? You get shortages. In this case, you got liquidity shortages as institutions pulled their limited money out of the repo market and put it elsewhere. That liquidity shortage sent repo rates spiking higher.

The overshoots in the repo market are a classic case of price fixing gone wrong. Meanwhile, record corporate and government bond issuance means that there is relentlessly increasing demand for the very same liquidity. In fact, there had been signs in the overnight markets since March that there was already insufficient dollar liquidity to properly fund record corporate and government debt issuance and the overnight market at the same time.

Since September, the Fed has embarked to rectify the liquidity shortage by creating a standing repo-facility and a new QE program (just don’t call it that). So while the spikes in overnight lending probably won’t return like they did in September, the demand for fresh Fed liquidity will only grow more severe as they keep cutting rates. Given that the Fed is very likely to cut rates again tomorrow (in the last 25 years, they have never not cut when the market implied probability of a cut was this high in the proceeding days), and given that federal and corporate bond issuance is likely to continue to grow rapidly for the foreseeable future, ever growing Fed liquidity injections are here to stay.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Great article! It is hard to see why people don’t see this, of course, most people haven’t even noticed. This is more panic than QE. A strong dislike and distrust of the Fed should not blind us to the idea this may still play out in many ways In an effort to avoid a crisis the Fed has been forced to deal with a liquidity issue in repo rates. While it is difficult to see the difference between QE and an injection aimed at maintaining liquidity, in this case, several reasons exist to believe this is not QE. More on… Read more »