Taps Coogan – January 5th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

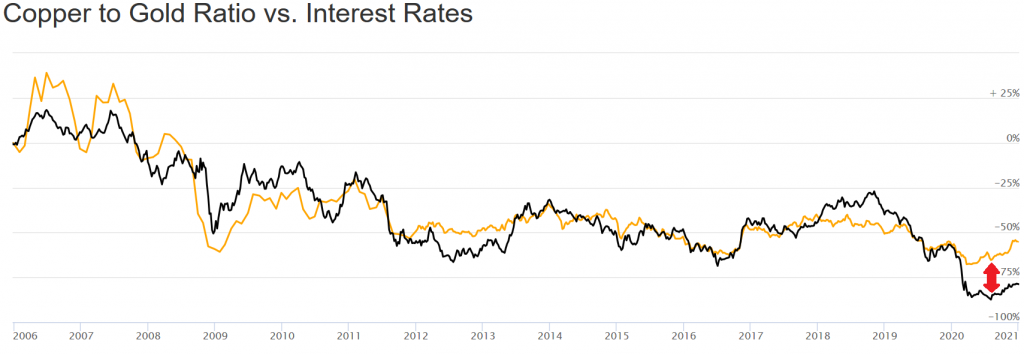

One of the relatively strong market correlations in the post Global Financial Crisis landscape has been the Copper/Gold ratio versus the 10-Year Treasury yield relationship. Over the years, DoubleLine Founder and ‘Bond King’ Jeffrey Gundlach has discussed the correlation as a tool for forecasting moves in the 10-Year.

The logic behind the forecasting ability of the correlation is that the copper/gold ratio speaks to the relation between economic activity versus inflation (copper) and monetary versus fiscal trends (gold), which is a pretty good proxy for what drives the 10-Year treasury.

As the following chart from Long Term Trends shows, the relationship has been remarkably tight since at least 2006.

Nonetheless, since the Covid pandemic started, the relationship has seen its most persistent divergence in at least 14 years.

The Fed’s response to the Covid pandemic has pushed the 10-Year to record lows. However, the Copper/Gold ratio hasn’t followed and is now slightly above the pre-covid level.

There are two implications. First, the Copper/Gold ratio is pointing to a inflationary and/or growth environment that has already surpassed pre-Covid levels (consistent with TIPS break-evens). Second, if the Fed took its foot off of the treasury market, interest rates would be higher than pre-Covid.

Of course, the Fed is not going to take its foot off of the treasury market anytime soon. Hence, the Copper/Gold ratio has probably transitioned from useful proxy for the 10-year to a measure of how much interest rates will rise whenever the Fed is eventually forced to end its monetization crusade. It will be interesting to see how wide the divergence is in another year or two.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. Also, please consider sharing this article so that we can grow The Sounding Line!

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.