Taps Coogan – July 19th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

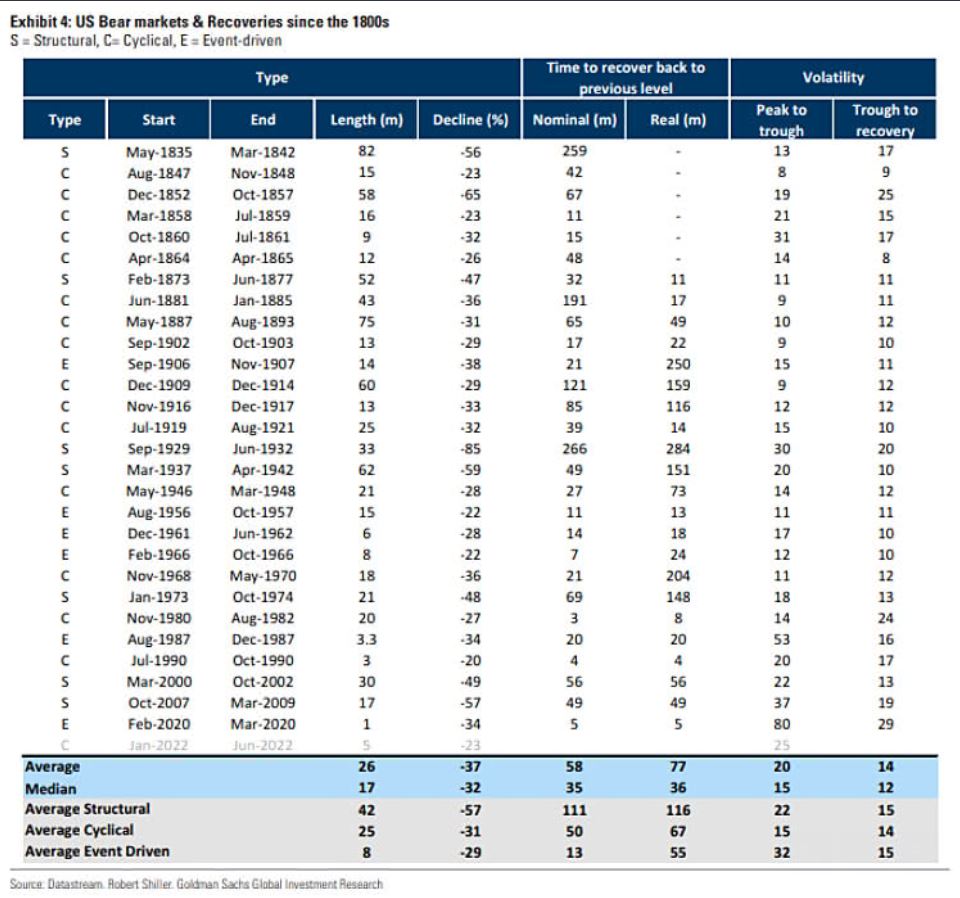

The following table from Goldman via Isabelnet, shows the basic statistics of every bear market (by their definition) in US equities since 1835.

The average bear market decline is about 37% for US equities, lasting just over two years. The median decline is 32%, lasting 17 months. The current bear market has, at it’s greatest decline, fallen about 23% and lasted five-to-six months.

As we’ve noted before, there are few-if-any examples of market declines much larger than the current decline that did not happen immediately prior-to-or-during a recession.

Arguably, this market has already priced in a mild recession. It has not, however, priced in an ‘average’ recession, and certainly not a financial crisis.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.