Taps Coogan – May 19th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

A couple of days ago we remarked on the near universal outlook we were coming across in the interviews we listen to and from the people we speak with. That outlook was: we may see a bond/stock rally from these levels but the bear market isn’t over and we are pointed towards a recession, though probably not until next year.

It’s an entirely plausible outlook, probably the most plausible, but the last time I remember hearing such a near universal agreement about an outlook was at the Covid lows in April/May 2020 when seemingly every public analyst/investor was saying that a ‘V’ recovery for markets was impossible. Of course, a ‘V’ is exactly what we got.

As far as Old Taps is concerned, if a recession is coming, it’s coming within the next couple months.

Why?

The market is saying so.

The S&P 500 is down 18.57% from its high at the time of writing, slightly above the low of -19.92% made roughly a week ago. Since 1950, there has only been one time when the S&P 500 has declined more than 24% from a local high that did not occur in the immediate run-up to a recession or during one. That single example is 1987, a cliff-edge crash with few parallels to today. There have only been two further examples of the market declining roughly 22% outside those parameters: 1998 and 1966. In other words, we’ve got room for a couple more bad days like yesterday, but beyond that and 1987, every time the market has been down more, it’s because we were imminently entering a recession or already in one.

The GDP numbers are also warning of recession.

Defining a recession is an arbitrary thing, but one of the technically accepted definitions is two consecutive quarters of negative real GDP growth. The advance estimate for the first quarter showed a 1.4% decline in real GDP, putting us one more bad quarter from a technical recession. That 1.4% decline was entirely driven by a mind boggling increase in the trade deficit, which may have been a ‘one-time’ affair, but the outlook for the second quarter isn’t exactly rosy.

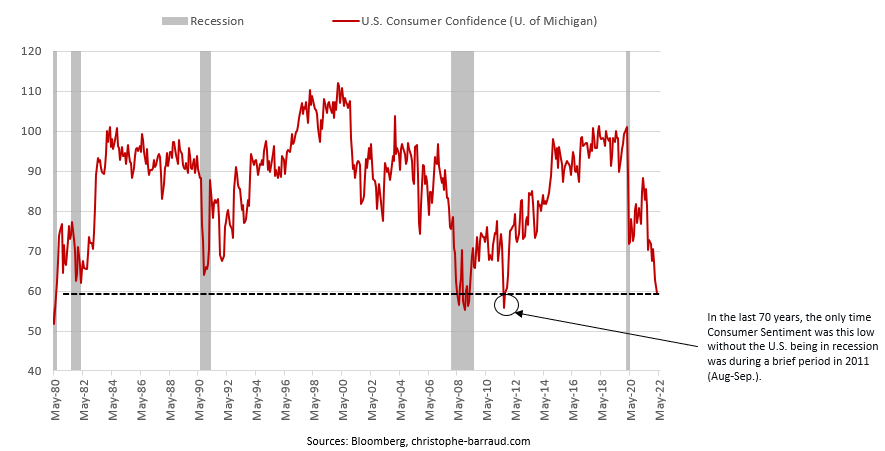

Consumer confidence is saying ‘recession.’

As far as consumer sentiment goes, we’re already in a recession.

Parts of the yield curve are saying ‘recession.’

The two parts of the treasury yield curve most commonly used for predicting recessions are the 10-year vs 2-year and the 10-year vs 3-month. The former inverted last month, the later didn’t and actually steepened. As far as we can tell the divergence is unprecedented, but this probably counts as a recession signal.

Finally, logic says ‘recession.’

We’ve made this point over and over and we’ll make it again. The 1970s was the post-war low-point in debt-to-GDP for the US economy, the high point for working age population growth, and stocks were unfathomably cheap compared to today. We were still the world’s largest manufacturer and ran a trade surplus. In other words, the economy could power through high interest rates for a decade, albeit with a few recessions.

Today, we are currently witnessing the exact opposite setup. We have the highest debt to GDP levels in American history, the working age population is shrinking for the first time on record. We run an insane trade deficit and stocks are coming off of some of their most overvalued levels in American history.

This economy cannot support a tightening cycle commensurate with 8% CPI. Things will buckle long before the Fed get’s anywhere near where they think ‘neutral’ is.

While 2% inflation is still a distant dream, the good news is that inflation may have peaked on a year-over-year basis. One more month of ‘falling’ inflation and the Fed could, if it so chooses, begin to say something a long the lines of ‘we’ll keep tightening but the pace of tightening may moderate as inflation appears to be moving in the right direction and economic activity is softening.’ Just that policy adjustment might be enough to put a bottom in markets and avoid a recession.

The bad news is that, after the last couple of years, one simply cannot expect Powell’s Fed to make sensical policy decisions. After the credibility-destroying calls on inflation, the Fed seems determined to prove they can now make the opposite mistake: tightening too aggressively into a weakening market and economy just to prove they can do it.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.