Taps Coogan – August 12th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

We’ve written a number of articles over the last two months (here, here, here, here, here, here, etc…) arguing that various contrarian indicators, like investor sentiment and cash levels, were signaling excessive bearishness.

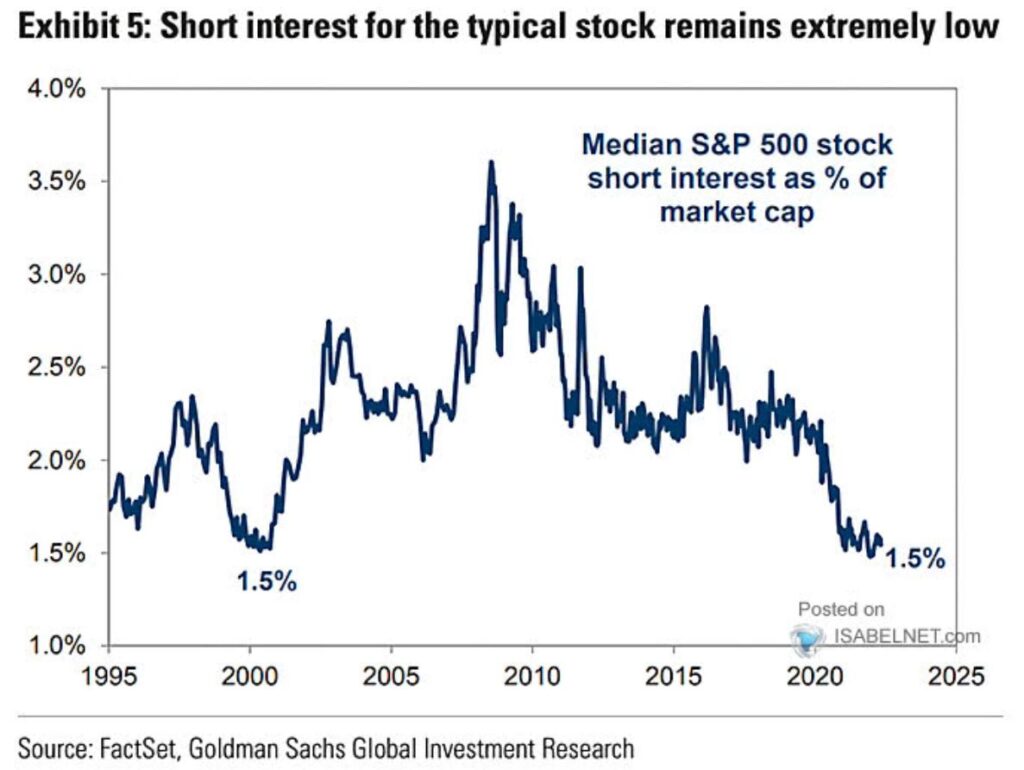

With markets now having rallied up significantly from the June lows, it’s worth reappraising the situation. Along those lines, the following chart via Isabelnet, shows that the median short interest on S&P 500 stocks remains very low.

While investor sentiment and cash positioning has been historically bearish as of late, actual short selling has been surprisingly light. That should give bulls some pause.

Short positioning is a classic contrarian indicator. Since 1995, shorting was the rarest at the heights on the Dot-Com bubble (and today) and at its peak near the lows in 2008 and 2009.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.