Taps Coogan – September 14th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

We wrote a series of articles in early 2020, right before Covid, looking at the large US shale plays in detail. We concluded that US shale oil and gas production levels were not sustainable in most basins without much higher drilling activity. Even then, the productivity of new wells in most basins was dropping, indicating that the most productive wells had likely already been exploited.

We argued that while production could continue to grow for some time by burning through the large inventory of previously drilled but uncompleted wells (DUC wells), the US shale oil and gas resource basin was probably within a few years of peak production and that much higher oil and gas prices would be needed to sustain the pace of drilling required to keep production up from that point forward.

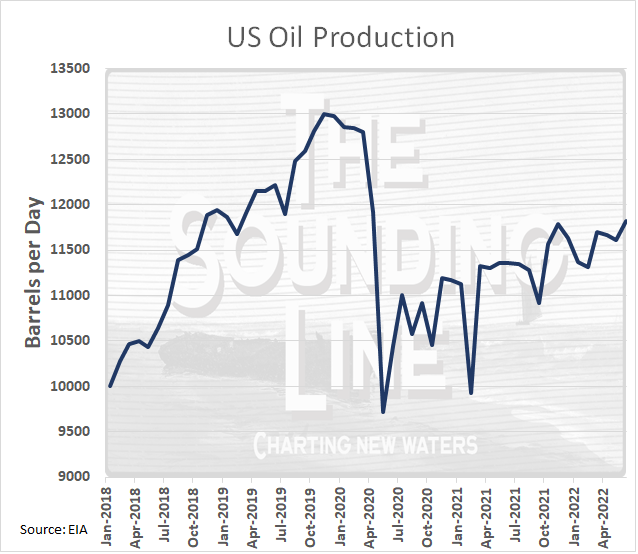

Fast forward to today and US oil production is yet to recovery to early 2020 levels.

The US shale resource is key to the global oil and gas picture because US shale has been responsible for roughly three-quarters of global oil production growth since 2008.

While endlessly vilified, US shale was one-of-if-not-the most important drivers keeping commodity prices and inflation ‘low’ from 2014 through 2020. That era of ‘low’ inflation is what in turn enabled years of excessive monetary stimulus, which in turn enabled endless deficit spending, all of which crescendoed in 2020 with Covid and a blow out low in oil prices, negative interest rates, and helicopter money.

Then came the energy crisis…

While compounded by years of bad policy choices, our energy crisis is, at its most fundamental, the result of the world running out of cheap oil and gas. Until a new resource basin is found, or a new technique for improving production is invented, we are going to be stuck in a self-throttling dynamic whereby high oil prices depress economic activity, which depresses oil prices, which depresses oil drilling activity, which means that when economic activity recovers, it is immediately throttled by a quick return to high energy prices.

That is our fundamental problem.

On top of that fundamental problem are the policy mistakes. Years of blocking of oil and gas pipelines and refining infrastructure as demand continued to grow has meant that there are numerous bottlenecks towards growing oil and gas production regardless of prices. Because governments the world over have signaled an intent to ban various fossil fuel industries and gas-powered cars, even if the those blocks were lifted, who is going to build a refinery or pipeline if its products will be illegal when it comes online in ten years?

Then there is the 100% wind and solar fantasy. Peak electric power consumption in most countries occurs after the sun has set in the winter. It is not unusual to have relatively windless multi-day periods over nation-sized landmasses multiple times a month. That means that ‘100% wind and solar’ requires battery backup that, in addition to handling multiple-day spans of humanity’s electricity demand, also needs to store energy all year for seasonal heating. To illustrate how wildly unrealistic that is, backing up just Germany’s current wind and solar generation will likely consume three times the global production of grid scale batteries forecast in 2030 and those batteries will need to be replaced every seven to ten years. Then there is the mind-boggling mineral intensity of wind, solar, and batteries. Where is the copper, lithium, rare-earth, cobalt, silicon, nickel, etc… going to come from when nearly every large mining project in the US has been blocked on environmental grounds in the past 18 months (here, here, here, here, here, here, etc…)?

Given all of that, and the increase in demand for electricity that electric cars and heating will create, one might think that nuclear would have been a high priority. Of course, the opposite has been true. The intentional regulatory sabotage of the zero-carbon nuclear industry by so-called environmentalist has meant that building a nuclear power plant in the West is a Kafkaesque nightmare and next-to-none have been built for 20 years. Those that have been built have been wildly over budget and behind schedule due to the regulatory sabotage and the absence of a skilled workforce that remembers how to build them.

So here we are. It will take a decade and hundreds of billions of dollars to build enough nuclear plants to make a difference in the US. In the meantime, wind and solar, while capable of offsetting some fuel usage, are of marginal importance due to the decades that separate us from meaningful grid scale storage (if it ever happens).

Until someone finds the next great oil and gas play or extraction technology we’re likely stuck in a feedback loop between recessions and energy prices.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

We are on a nihlistic death spiral enforced by green religious zealots whom we seem unable, or unwilling, to resist. But other than that…everything is great.

Excellent article regarding energy situation facing U.S. and World. Missing is the need to cooperate with other Nations, including Russia to meet future needs. We sometimes forget the basis for Free International Trade is Comparative Advantage and Interdependence—without acceptance of these principles , we could face scarcity, energy wars and collapse of our world economic/financial system. Ukaine, which started as a regime change challanging strategic occupation of Crimea and Donbass has morphed into an Energy Trade War, for instance.

Ukraine threw out a Russian puppet.

Russia views Ukraine as their territory and the rest is narrative and spin.