Taps Coogan – May 12th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

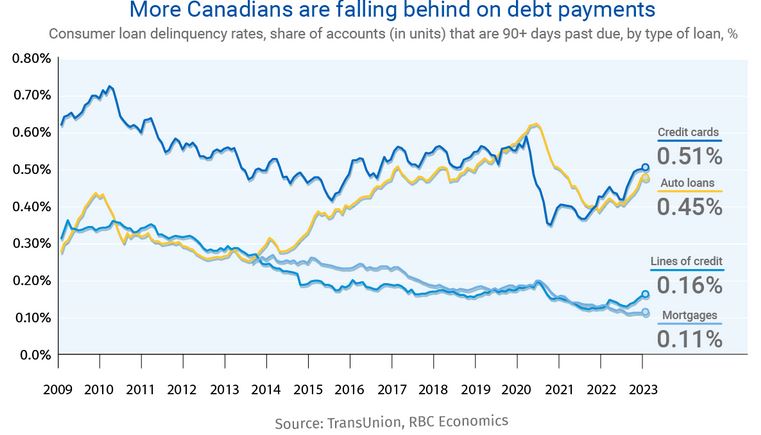

While not particularly high from a historic standpoint, overall delinquency rates in Canada have started to rise, as the following chart from the Royal Bank of Canada highlights.

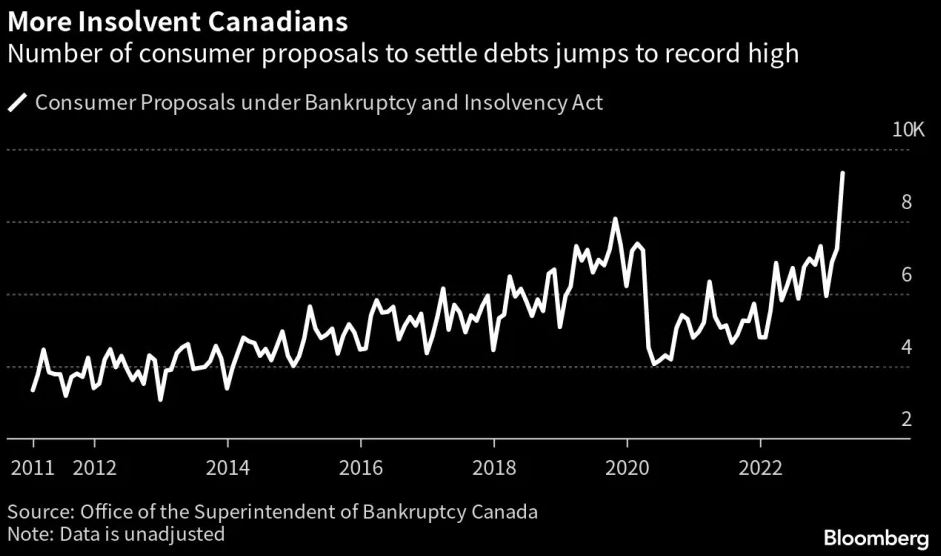

Meanwhile, the number of proposals by Canadians to negotiate alternative arrangements to restructure debts under Canada’s Bankruptcy and Insolvency Act has surged 36% from a year ago, hitting an all time high. Via Bloomberg:

The implication of the two charts together is that Canadians are requesting debt restructuring under bankruptcy law at the highest rate since the Global Financial Crisis and that lenders are largely accommodating those requests – presumably via extending amortization periods, avoiding formal delinquencies for now.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

It would be interesting to see how much of that is New Canadian™️ credit/debt slaves. I have a theory that most of the immigration we see all across the western world is in one form or another nothing but cynical power play and reflating the Ponzi scheme of the western ruling psychopaths. For example, how better to get American debt and entitlement/benefit tsunami to a manageable, down-the-road-lockable size than to reflate the Ponzi scheme with warm bodies like Biden said years ago; was it “America needs 400 million immigrants”? Ruling class psychopaths importing long mostly brown people to keep their… Read more »