Submitted by Taps Coogan on the 31st of May 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Here at The Sounding Line, we have written about the looming public sector pension fund crisis on a number of occasions (most recently here).

At the core of the problem is a growing difference between the amount of money public sector workers are paying into pension funds and the amount of money that they are receiving in benefits. In stark contrast to private sector retirement plans, employee contributions to public sector pension funds can be as little as 3% for the first 10 years of work and nothing after, while benefits are often as much as 70% of their ending salary, for life. It is self-evident that 3% of one’s salary for the first 10 years of one’s career is not remotely enough money to support a pension equal to 70% of one’s ending salary every year for decades following retirement. Without a tax payer backstop such a retirement plan would be inconceivable. It should come as no surprise that the private sector retirement plans, which are not tax payer backstopped, have much higher employee contributions, lower benefits, and few if any unfunded promises.

Traditionally, the difference between modest contributions and generous benefits has been made up by three factors: increasing number of workers contributing to the pension fund, large investment returns on the pension fund assets, and tax payers. However, all three of these factors appear unable to keep up with growing unfunded pension liabilities.

As the baby boomer generation reaches retirement age, the number of people collecting benefits from their pensions is set to surge while the relative number of young people working is declining. Furthermore, ultra-low interest rates have dramatically lowered pension fund investment returns. According to a recent report from the Hoover Institution, on average, public pensions (state, local and federal employee pension plans) assume that they will achieve a risk free 7.6% return on investment per year, every single year. In an era where actual ‘risk free’ returns on sovereign debt such as 10 Year US treasuries is below 3%, this 7.6% expectation is ‘wildly optimistic,’ forcing pension funds to chase returns in ever riskier asset classes.

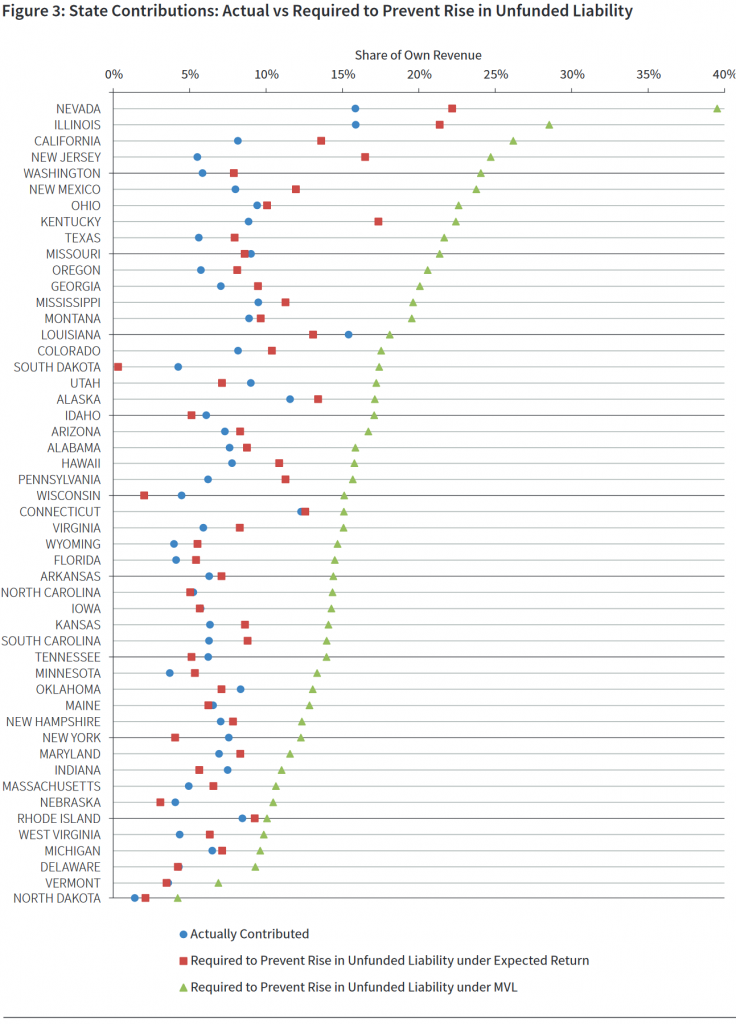

According to the Hoover Institute, even with this ‘wildly optimistic’ accounting, US public pension funds are short $1.191 trillion dollars. Worse yet, once the increasing risk profile of pension fund assets is accounted for, and more realistic market values are applied to pension funds’ assets, the underfunding problem rockets higher. As the following chart shows, using a more realistic market valuation of pension fund asset values, the amount of additional contributions needed to keep unfunded liabilities at pension funds across the US from rising even further range as high as 39% of state tax revenues (the green indicator is the percent of state tax revenues required)!

This brings us to the final problem for public sector pension funds. Tax payers may no longer be able to make up the difference. Taxes in many of the worst effected states are already at or near historic highs. Raising tax rates far higher is not guaranteed to significantly raise revenues, but is guaranteed to destroy jobs and slow growth (as Connecticut is already finding out). Furthermore, it is questionable whether it is politically feasible to continue raising taxes on private sector workers in order to fund far more generous retirement benefits for far better paid public sector workers. Given these realities, and the reality that pensions represent the second largest element of average American household wealth, it is quite hard to conceive of a good ending to this problem for tax payers or for pensioners.

P.S. We recently added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

The government has wanted to do away with unions and pensions for some time at the bequest of private industry greed. Zero Interest Rate Policies ZIRPs did more to make pensions insolvent than anything else. Companies like Pfizer are allowed to keep over $50B offshore tax free but we are told nobody can afford to pay someone who has worked their entire life a pension, yet illegals can get welfare. How long do you think this will continue?

It is true that ZIRP has been a disaster for pensions and retirees and it is in that dynamic that one can see how the Fed’s attempt to recover from one financial crisis will end up causing another. Letting a handful of academics try to allocate risk and return across an endlessly complex economy always ends badly. A lot of politicians and union leaders got elected or reelected by promising pensions and benefits that could not be sustained under any realistic scenarios and they knew it. I am not sure that has much to do with private sector greed. Nobody… Read more »

Your numbers for Texas are incorrect. Since September, 2015, State employees pay a non-optional 9.5% of base salary into the State of Texas pension plan. That number may differ for employees of the school districts and for State employed first responders. Many of those employed by the State of Texas are NOT members of a union.

Thank you for your interest and comment.

I don’t recall anywhere in the article where I say what the employee contribution for the State of Texas pension plan is or that every one that works for Texas is a union member. In fact, I don’t say anything about Texas at all.

As you point out, contributions vary by pension plan and state, and as you can see in the chart, some states are in better shape than others.

North Dakota doing well?

Could it be that they did not purchase any of that MBS crap? Or is it that they have their own State bank, and any politician that suggested going private would have been strung up….

Why is North Dakota doing well when Chicago is not?

Hmmmm…. Must be some unusual policy?

North Dakota has been the largest benefactor of the shale oil/gas boom in the US. Because the state has a relatively small population and government, the increase in state revenues goes a long way.

I would love to share this article on twitter, but I can’t find a button.

Sorry for the inconvenience. I recently removed the share buttons due to chnages I am making for the EU’S GDPR reguLation. You should find them now. Thanks