Taps Coogan – July 6th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

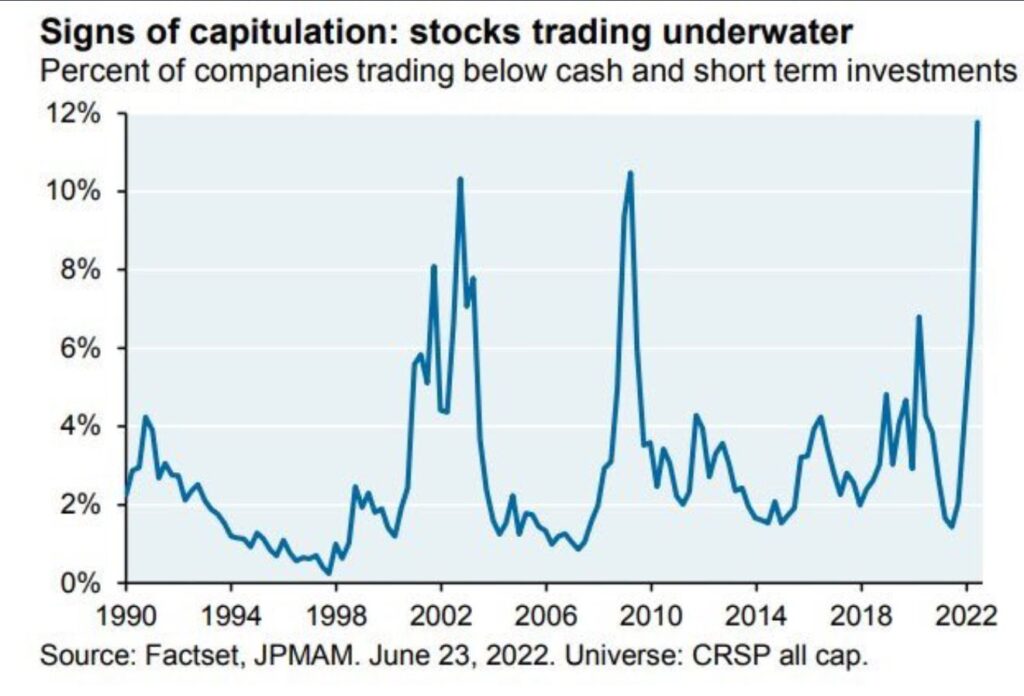

The following chart, from Charles Schwab Chief Investment Strategist Liz Ann Sonders, shows the percentage of companies trading below the value of their cash and short-term investment holdings.

Of course, in recent years the percentage of listed companies that lose money has been much higher than ever before, making some of the rise shown above justifiable and not necessarily a sign of undervaluation. Nonetheless, this data set has been a contrarian indicator of both of the last major market lows, including the Dot-Com bubble that saw a good number of unprofitable companies.

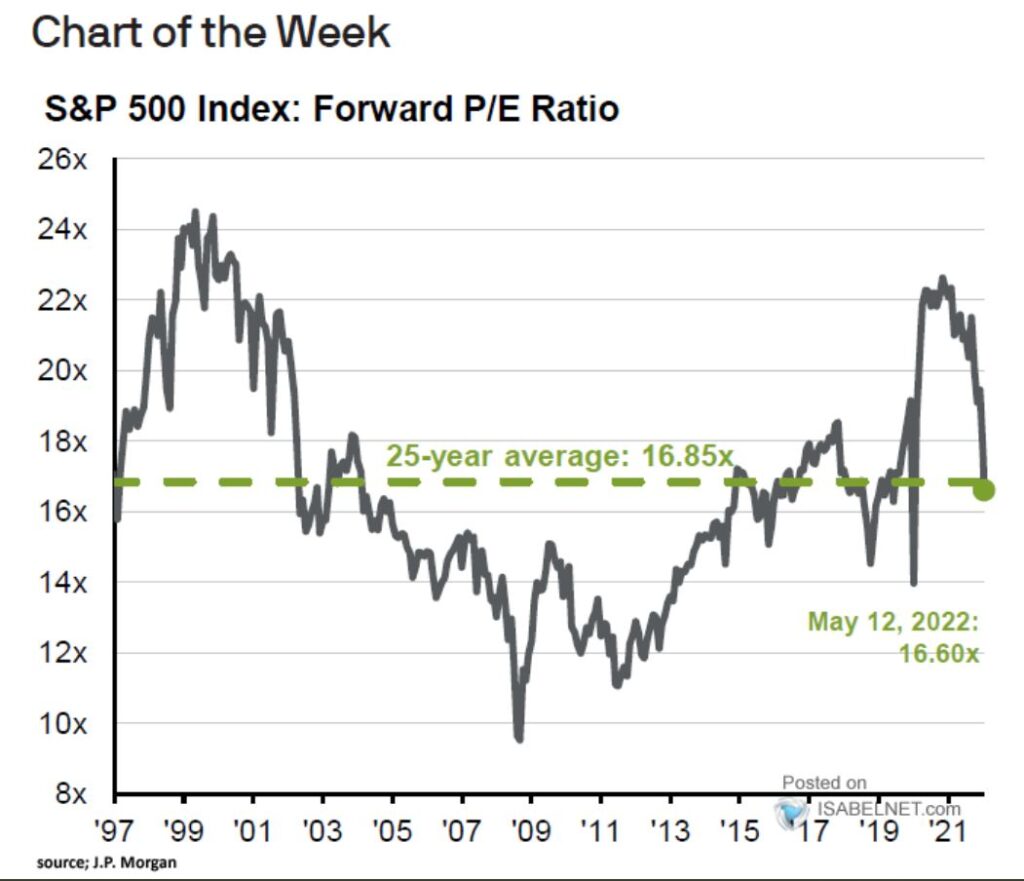

As we noted back in May, the S&P 500 forward price to earnings ratio is below the 25 year average (a period that has admittedly included a lot of bubbly valuations).

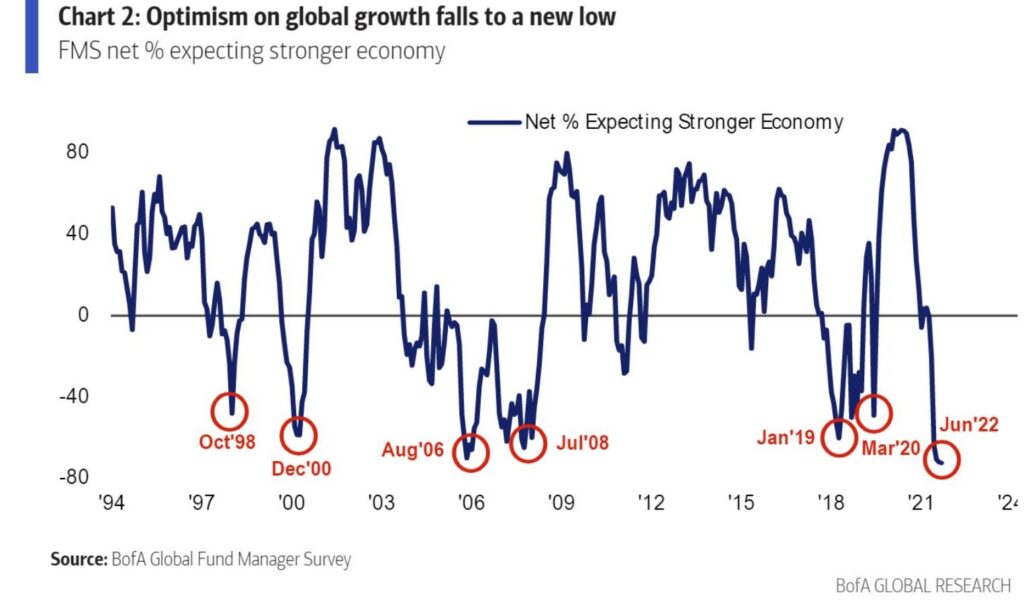

As we noted in June, fund managers are the most bearish on global growth on record.

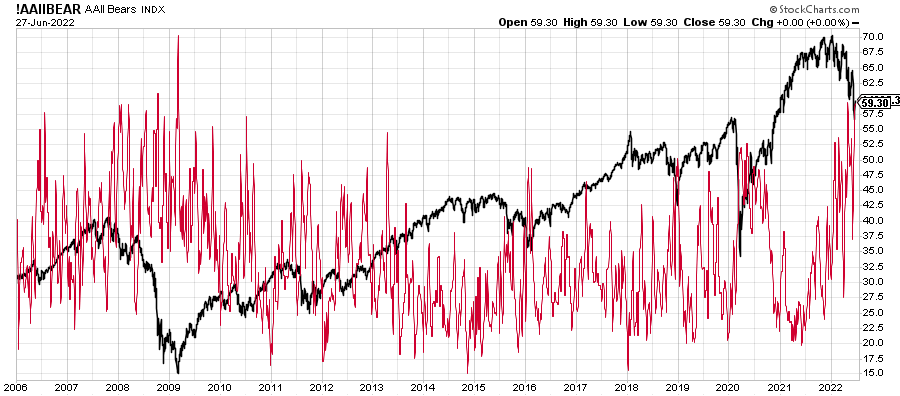

Retail investors were only more bearish shortly before the market lows in 2009.

Of course, with markets having gone to such exaggerated highs, it wouldn’t be out of place for them to now make much more exaggerated lows than what we’ve seen so far. The earnings downgrade cycle, and a rise in unemployment commensurate with a potential recession, also haven’t started yet, nor do we have the softening in monetary policy that would likely be required to sustain a rally in markets. So these contrarian indicators are probably very early.

Nonetheless, barring a few months in 2020, this is the first time in many, many years when one could argue with a straight face that stocks weren’t egregiously overvalued. It is worth at least pondering whether the recession, assuming we get one, ends up being of the ‘mild’ variety. Most commodity prices have also fallen pretty dramatically in the past months, setting the stage for a drop in year-over-year inflation that could give the Fed room to start slowing the pace of tightening.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.