Taps Coogan – February 10th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Another day, another reminder of just how disconnected markets have become from underlying realities.

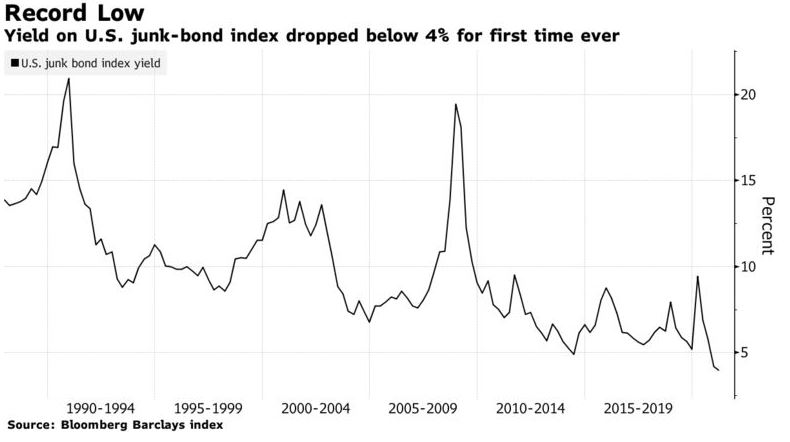

The following chart, from Bloomberg, shows the average yield on US junk bonds. It fellow below 4% for the first time ever on February 8th, 2021.

Meanwhile, Fitch is anticipating that default rates on junk bonds will remain between 5% and 6% through 2022.

That’s right, the average junk bond is now yielding meaningfully less than its anticipated default rate. Real ‘yields’ on junk bonds, when adjusted for likely defaults and implied inflation, are negative.

Of course, junk bond investors don’t care. With yields on everything falling inexorably, they’re doing perfectly fine. In a world where practical jokes have billion dollar market caps, what would stop nominal junk bond yields from hitting zero or less? Greater fools abound.

The End Game

If it isn’t clear yet, here is what’s happening:

Central banks are trying to engineer a world where the entire duration spectrum of corporate and government bond markets are yielding less than the combined inflation and default rates. They believe doing so will prevent defaults and give borrowers a chance to outgrow their debts through inflation.

It’s a nice sounding idea as long as you don’t think about it for too long.

Six years of zero rates and trillions of dollars of QE following the Financial Crisis never succeeded in getting growth higher than the rate of debt accumulation. To the contrary, debt exploded and growth stagnated as capital mis-allocation and over financialization abounded. The new plan is that even more of the same medicine will work better this time.

Why are we stuck here? It’s a thoughtcrime to learn any lessons from 2017 and 2018, when aggressive pro-growth economic policies enabled the Fed to tighten policy and achieve their inflation target while the nation enjoyed strong job and wage growth, and acceptable GDP growth, and decent market returns. Frankly, those policy choices are no longer a real option anyways.

Whenever rates bottom out, whether that be with junk bonds at 3% or -3%, bond holders are going to be the bag holders for all of this monetary and fiscal insanity.

Until then, the bull market in moral hazard is raging.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. The Sounding Line is now ad free and 100% reader supported. Thank you to everyone who has donated.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.