Taps Coogan – February 21st, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

All of the big western central banks have been raising their benchmark rates since the middle of last year with one major exception: the Bank of Japan. Via Acemaxx Analytics:

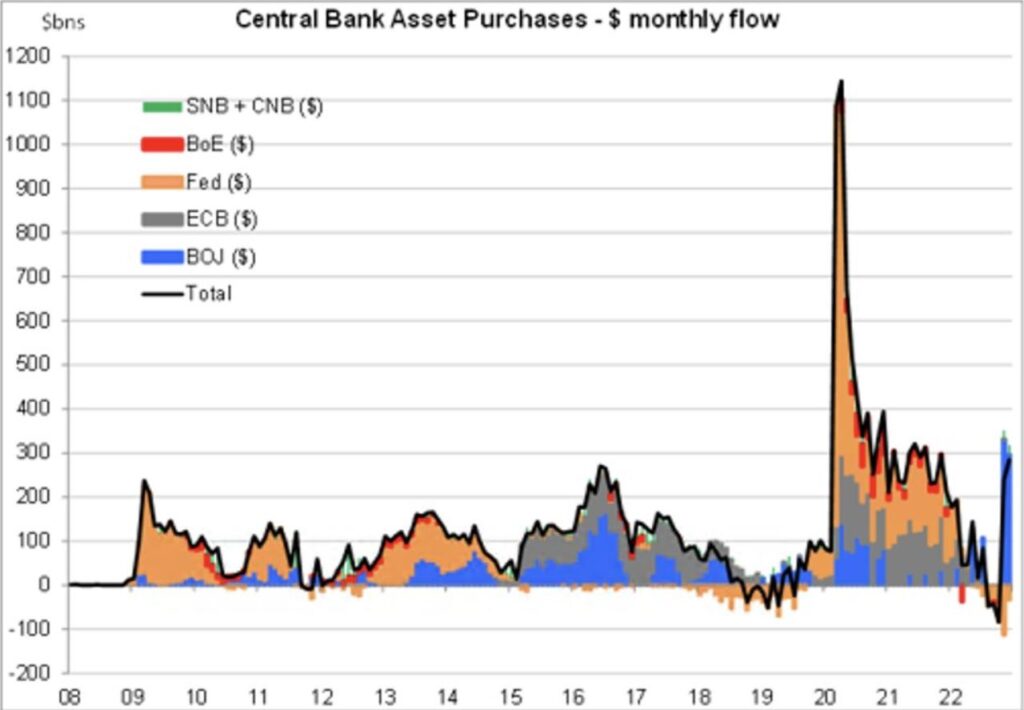

Not only is the Bank of Japan still not raising its benchmark rate (which has been near zero since 1996), it is fighting to hold on to yield curve control, leading it to do massive amounts of quantitative easing (QE) since the start of the year.

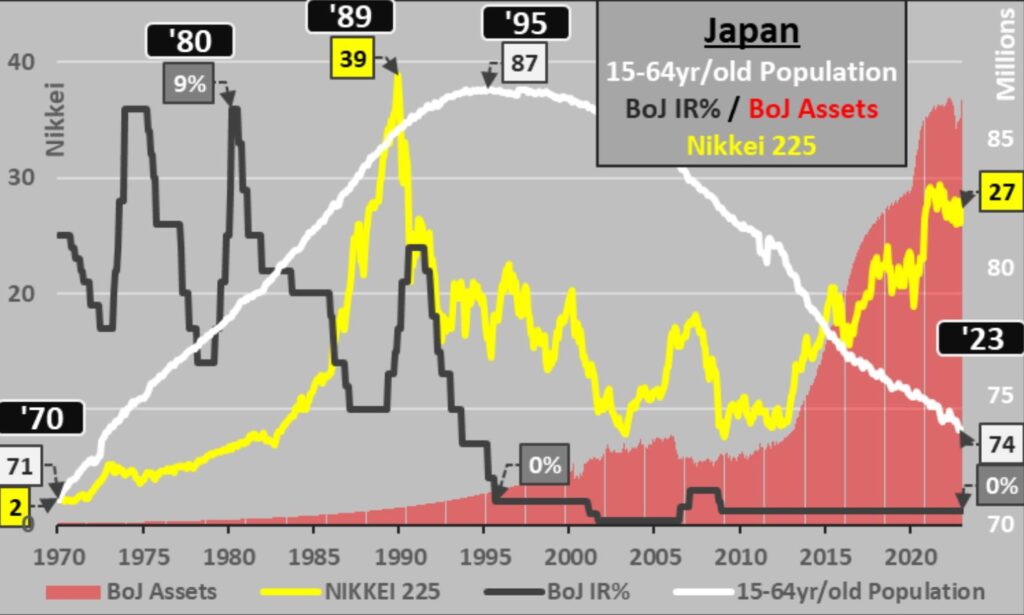

The following chart from ‘Econimica‘ highlights what makes Japan so special. Its working age population has been declining since 1995.

The overwhelming lesson of Japan’s experience with a shrinking workforce is that it is deflationary. As we have written many times over the years, the contraction in endogenous money growth caused by a shrinking aging population and has outweighed 30 years of QE, zero interest rates, and deficit spending …at least until Covid.

The novelty with Covid, which we pointed out in early 2020, was helicopter money. Central banks monetizing direct cash payments/loans to consumers had never been done at scale before and was directly inflationary. The Bank of Japan’s soon-to-be-departing head, Kuroda, is betting that because the helicopter money phenomenon is over and supply chains are renormalizing, and because Japan still faces the same deflationary demographics headwinds, it can ride out this inflationary wave without adjusting policy. He might be right.

Of course, beyond ‘helicopter money,’ the other two great drivers of inflation are war and energy crises, both of which yours truly sees as likely to get much worse in the next few years, so who knows.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Its working age population peaked at 87 million in 1995, it didn’t peak in 1987.

My mistake. Fixed it. Thanks

Let’s see how high the current CPI inflation spike goes.

4% and rising.

https://tradingeconomics.com/japan/inflation-cpi/

When a central bank allows its government to overspend and abuse its currency, something has to give. This is one of the unwritten laws of fiat currencies. When the value of a currency falls, a country and its central bank cannot save both its currency and its bonds. https://brucewilds.blogspot.com/2023/01/a-country-cant-save-both-its-currency.html