Taps Coogan – February 22nd, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

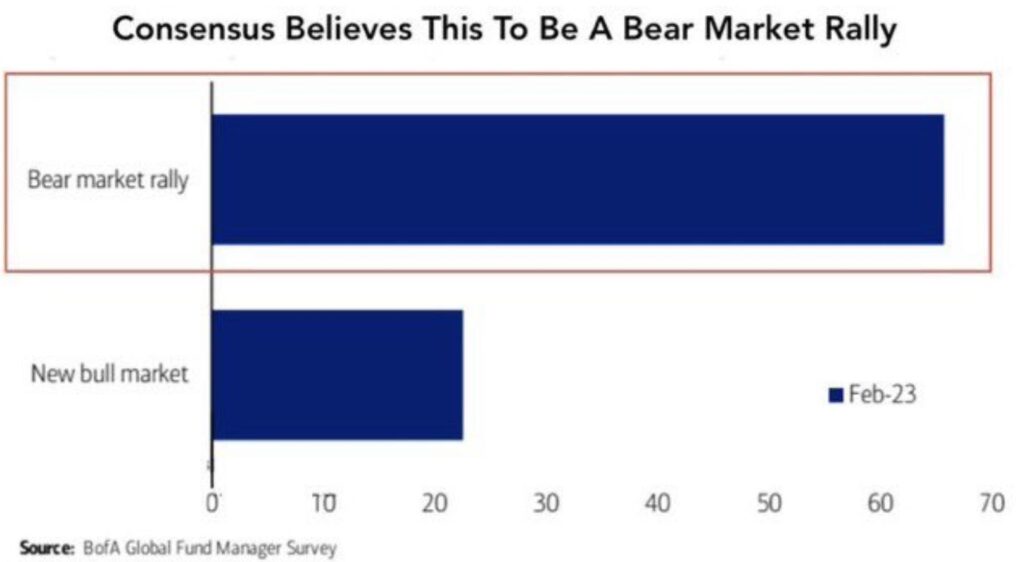

According to Bank of America’s benchmark Fund Manager’s survey, the vast majority of managers still see us as being in a bear market. Via Andreas Steno Larsen:

The results are reassuring in so much as yours truly was starting to hear more and more predictions that recession had been averted and the bear market ended. The basis for that change in sentiment seemed to hinge on the rally in stocks over the last few months and continued strength in the labor market.

As we’ve been noting since day one here, labor statistics are lagging indicators and shouldn’t be used for forward looking statements. The average time between the cycle low in unemployment and the start of a recession is less than four months.

Pointing to an inevitable rally after a year of bearish action in stocks is also a pretty weak basis upon which to change one’s mind about a bigger picture outlook, even if that rally took out some intermediate resistance.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.