Taps Coogan – May 13th, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Yesterday’s hot 3.6% CPI print apparently ‘surprised’ a lot of economists and market watchers, though it certainly shouldn’t have as the signs have been everywhere for months that CPI was headed over 3%.

Nonetheless, many analysts are still writing-off the jump in inflation as a “base-effect,” a concept that the Fed has been promoting for months now. What the Fed means by “base-effect” is that year-over-year comparisons are now being calculated against April of 2020, when the US was in the clutches of the first lockdowns and inflation was dropping. Hence, according to the theory, this April’s year-over-year inflation numbers will look artificially high and, as time goes by, the year-ago comparisons will be to more ‘normal’ months and the inflation rate should drop.

While this is true to a degree, it is being grossly overstated at the present moment for two simple reasons.

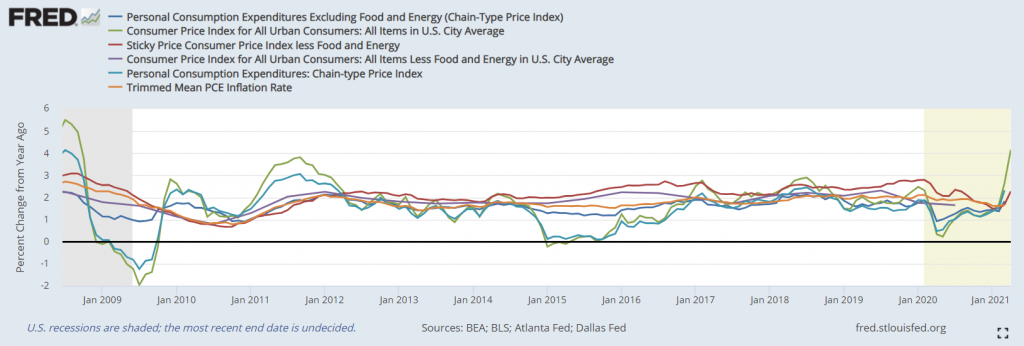

The first is that none of the major inflation measures went negative on a year-over-year basis last year, as the following chart shows. Yes, they all dropped on a monthly basis during the recession. However, the ‘low’ inflation numbers last April still represented price increases compared to April 2019. Put differently, the base effect is weaker today than it was in 2016. The Fed wasn’t crowing endlessly about “base effects” in 2016. They were slowly raising rates.

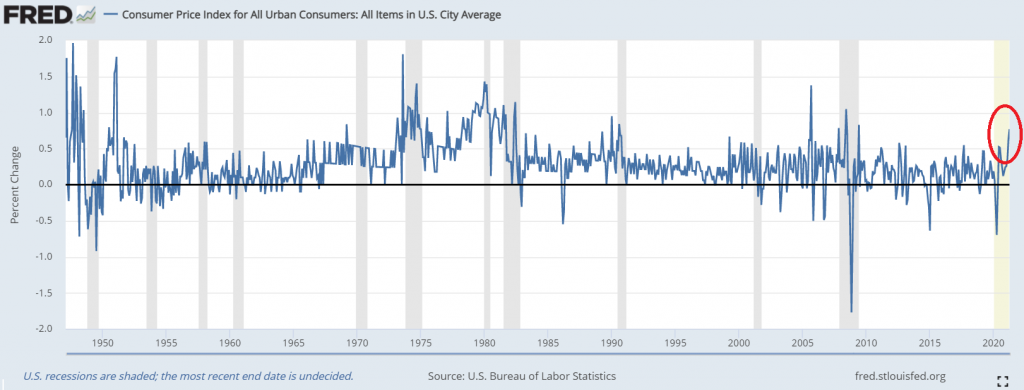

The second and more important reason that the “base effect” argument is a moot point is that prices are not only surging compared to last year, they are also surging compared to last month. April saw the fastest month-over-month increase in CPI (0.77%) since 2009 and one of the fastest monthly increases seen since the high inflation of the late 1970s. CPI was already a hot 2.6% in March. In other words, prices increased at a breakneck pace in April compared to a hot read in March.

Month-over-Month CPI Change

The Fed knows all this. This is their bread and butter. The charts above made using the St. Louis Fed’s data tool. The Fed believes inflation will prove transitory and is making up excuses as they go as to why they don’t need to worry about tightening policy.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.