Taps Coogan – February 7th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

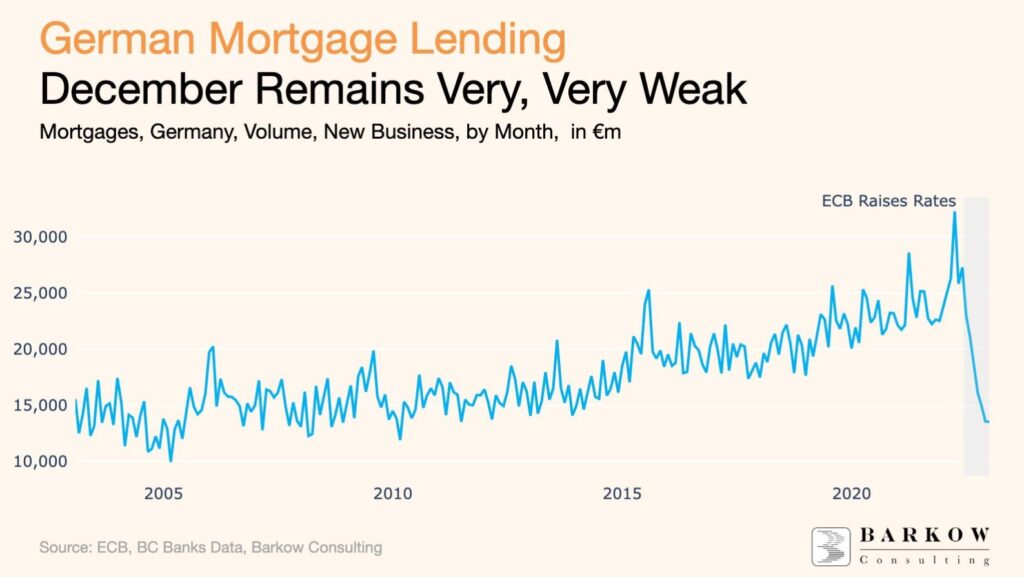

As the following chart from Barkow Consulting highlights, via Holger Zschaepitz, mortgage lending in Germany had frozen up since the European Central Banks (ECB) started hiking rates.

Such a severe contraction in mortgage lending is going to have a knock on effect on real-estate values and, while that has started, it will take much more time for the full impact to be felt as many sellers will pull homes from the market and hope for better conditions down the road. In the meantime, new home construction, one of the more GDP ‘intense’ activities, will likely slow to a trickle.

Expectations for a European recovery this year have been building as energy prices come down. Those expectations should be should be handicapped by the reality that the Eurozone economy is even more interest rate sensitive than the US and the ECB is even further behind in its tightening cycle.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.