Taps Coogan – December 22nd, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

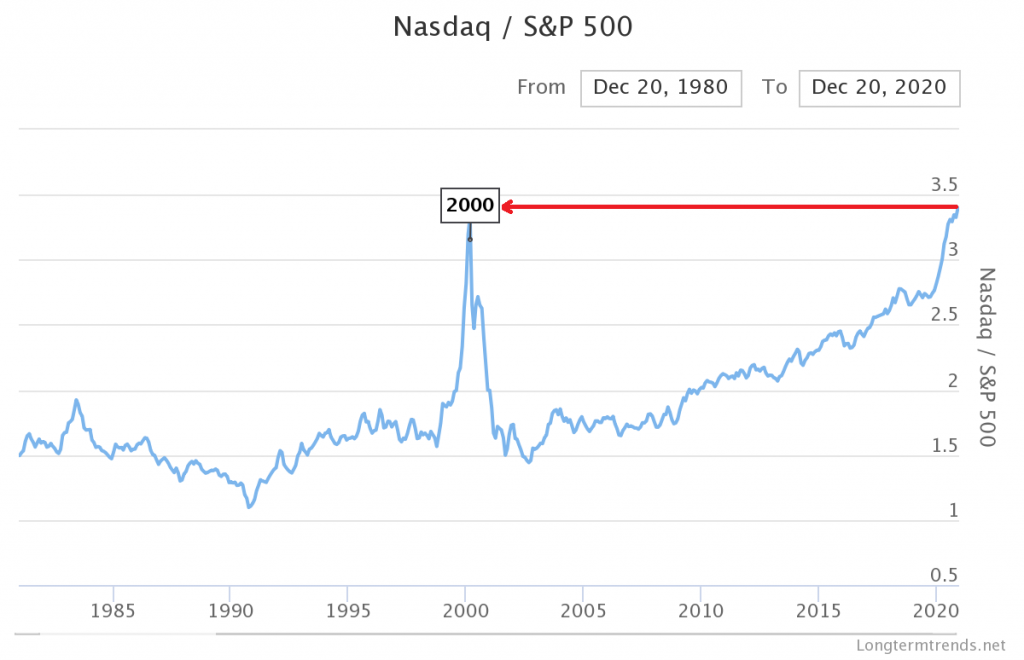

Here’s one for the history books: the ratio of the tech-centric Nasdaq index to the S&P 500 has reached the highest level ever recorded (3.4) this December, eclipsing the peak of the Dot-Com bubble (3.3) for the first time.

Whereas the Dot-Com bubble caused a brief and conspicuous spike in the Nasdaq/S&P 500 ratio from 1999 through 2001, the current record is the result of years of trending since the Global Financial Crisis, followed by a Covid inspired surge in tech stocks this year.

There is a case to make that this trend is at least partially a reflection of the real structural rise of technology in the economy. Then again, some back of the envelope math reveals that sustaining current growth in the Nasdaq (up roughly 42% year-to-date) implies its market cap overtaking total global GDP by roughly 2024. Needless to say, that seems unlikely.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. Also, please consider sharing this article so that we can grow The Sounding Line!

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.