Taps Coogan – September 15th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

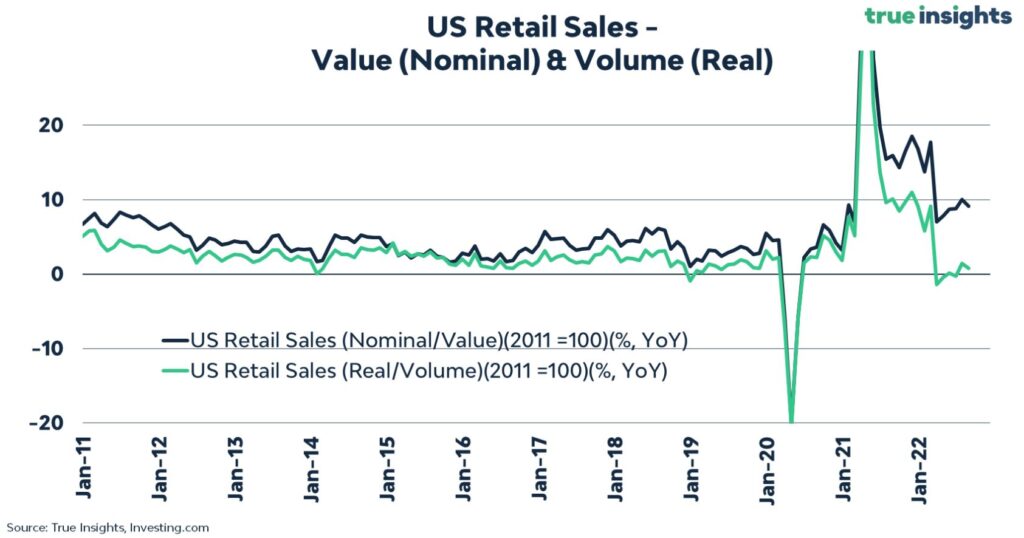

The following chart, from True Insights via Jeroen Blokland, captures the trends in retail sales that explain the surge in inflation and the predicament that we currently find ourselves in.

The explosion of retail buying in 2021, fueled by pent-up demand from the lockdowns and the trillions of dollars of helicopter money, debt forbearance, ‘payroll protection’ grants, eviction bans, expanded unemployment insurance, etc… created an unprecedented surge in demand for goods. That surge was so big that it doesn’t even fit in the chart above.

That immediately spiked prices, snarled supply chains that were already handicapped by Covid, and kicked off an inflationary spiral. We started repeatedly warning about that inflation risk all the way back in April 2020.

Fast forward to today and the volume of retail sales has finally starting flatlining, with little-to-no growth compared to the admittedly high levels of last year. Meanwhile, the dollar value of retails sales keeps marching forward, up nearly 10% over last year’s already high levels thanks to inflation.

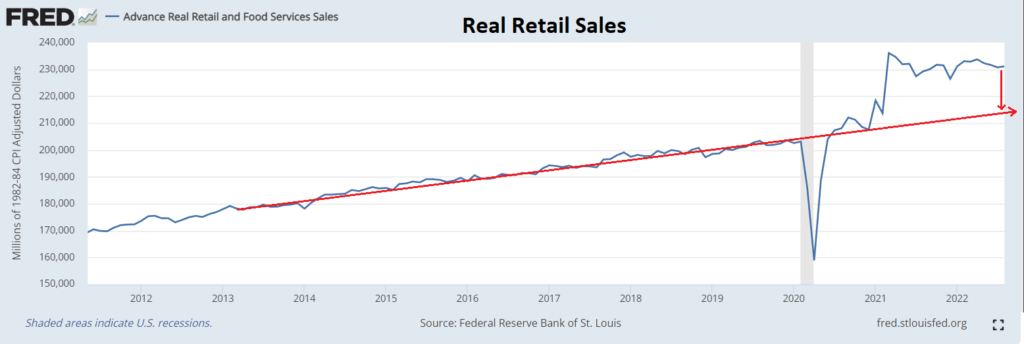

For inflation to moderate, the volume of retail sales needs to do more than just flatline. It needs to get back to the pre-Covid trend. For those that are wondering where that is, that’s something like a 8% decline in the real volume of retail sales from current levels.

Getting back to that growth trend will be indistinguishable from a recession on a rate-of-change basis. In an absolute sense, that’s just returning to growth trend and is hardly the end of the world. Of course, things tend to ‘over’ correct when they are this out of line.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.