Submitted by Taps Coogan on the 7th of January 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

As we have previously noted, the magnitude and impact of the economic under-performance in Southern Europe is much under-appreciated. Combined, Italy, Spain, Portugal, and Greece have a population of over 126 million people and a GDP of roughly $3.7 trillion (2.99 trillion Euros). If the region were a country, it would be the 10th most populous in the world and the fourth largest economy after the US, China, and Japan. Despite its size and importance to the global economy, Southern Europe still has not fully recovered from the financial crisis that struck the world a decade ago.

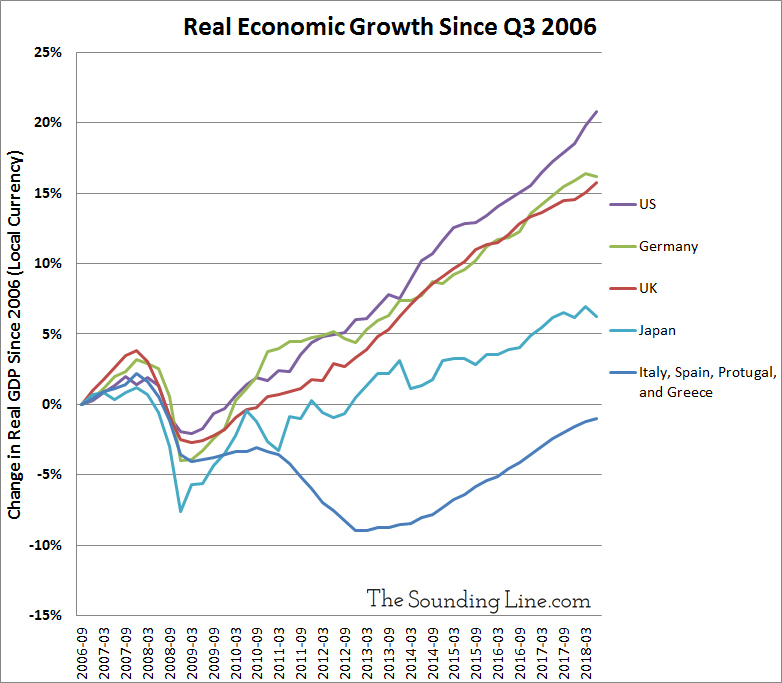

The four countries’ combined economies are still smaller than they were at the end of 2006, when adjusted for inflation. Nonetheless, their combined national debts have ballooned by over 70% since then.

Southern Europe is the only developed economic region in the world to see no net economic growth since the financial crisis. By comparison, the German economy has grown by 16%, the UK by 16%, the US by 21%, Japan by 6%, and China by 153% since 2006.

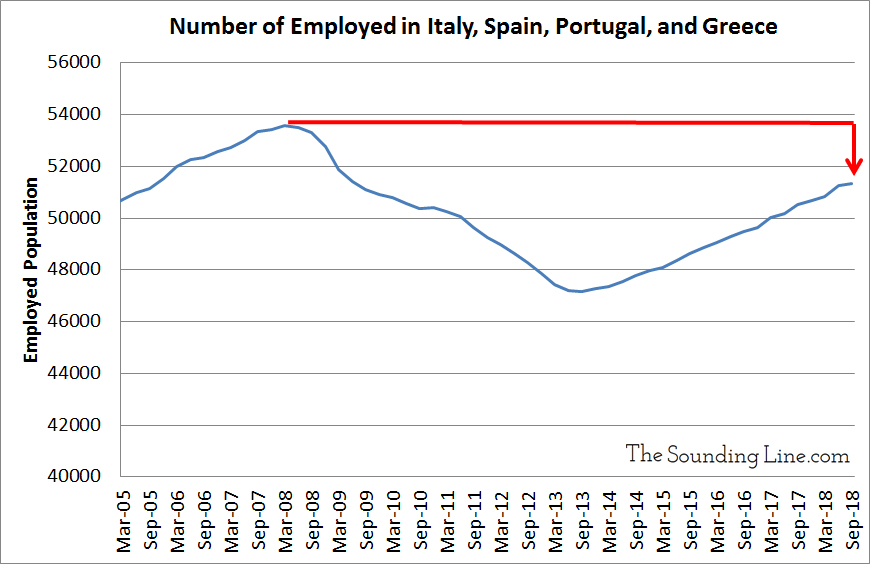

The number of people with jobs in the four countries is, similarly, still smaller than it was in September of 2005, despite their combined populations growing by over three million people since then. As with the broader economy, Southern Europe is also the only major economy in the world to have fewer workers than a decade ago. Even Japan, whose population is shrinking faster than any other country in the world, has witnessed an increase in its employed population relative to its pre-crisis peak.

Even the modest recovery that the economies of Italy, Spain, Portugal, and Greece have enjoyed for the last three years appears to be coming to an early end. December PMI data suggests that Eurozone growth is slowing to its lowest levels in years, and that Italy could be entering a technical recession right about now.

The deteriorating economic data now coming out of the Eurozone forces one to contemplate what would happen if Southern Europe were to fall into recession in the current environment.

Consider that a decade of the lowest interest rates in the history of the world (literally), and a QE program twice the relative size as the Fed’s, could not rehabilitate Southern Europe.

Whereas the Fed has been raising rates and reducing its balance sheet for years now, the ECB has left their benchmark rates at record negative lows, and just stopped expanding its balance sheet in December. That means that the ECB’s policy options in the next recession are very limited.

The real problem for Southern Europe, and to a lesser extent the entire Eurozone, is that the rest of the world is leaving them behind in terms of economic growth and monetary policy. It was the high degree of policy synchronization between all major central banks that limited the negative effects of extreme montiary policy in the wake of the last financial crisis. Whether the rest of Europe, let alone the US, will follow Southern Europe into ever more absurdly accommodative monetary policy in the next recession is questionable. It’s one thing to cut interest rates deep into negative territory and print trillion of dollars when everyone is doing it. It’s a whole different ballgame when it’s just you.

That is what Southern Europe and by extension the rest of the Eurozone have to look forward to in the next recession, if pro-growth economic reform remains impossible.

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.