Submitted by Taps Coogan on the 28th of December 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Beyond the near term reality that markets don’t move in a straight line, there is a short and long term bullish case for US stocks.

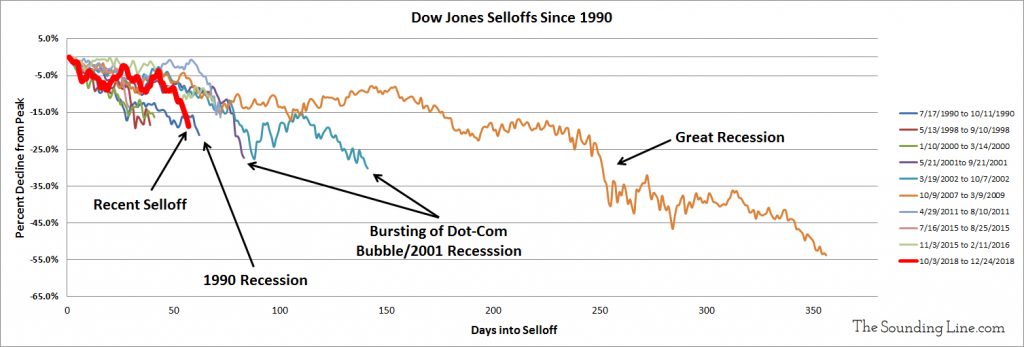

The short term case: The recent 19% selloff in the Dow was the sharpest since 1987 to occur when the economy was not in a multi-year bear market or recession. Even relative to selloffs immediately before recessions, it was large. When the US economy entered into recession in March of 2001, the Dow was off 16%. When it entered a recession in December 2007 the Dow was off less than 7%. By the time US GDP growth was negative in Q1 2008, the Dow had declined less than 14%. While the Dow would decline 54% during the ‘Great Recession,’ the bulk of the decline came during the depths of the recession and financial panic. Considering that GDP growth is still above the average for the current economic cycle, and still forecast to remain decent next year, the recent sell-off is premature based economic fundamentals alone. Unless the US enters a recession imminently, selloffs don’t get much worse or longer than this. Of course, the recent selloff is not based on fundamentals alone. It is largely a reflection of the end of global QE in October of this year.

The longer term case: Chief among the ‘economic’ concerns we highlight here at The Sounding Line has been the de-coupling of financial asset prices and real economic fundamentals. That de-coupling is the result of a trend towards increasingly accommodative monetary policy that has been building since Alan Greenspan took the helm of the Federal Reserve in 1987. Unduly accommodative policy has repeatedly led to financial asset bubbles, it has delayed structural economic reform, widened the wealth gap, and led to systemic malinvestment, not just in the current economic cycle, but increasingly for the last 30 years.

If we are to escape that ‘doom-loop,’ we need a few things. The first is a Federal Reserve that is willing to set monetary policy based on economic fundamentals, not financial asset prices, and which will not use financial bubbles as a tool to boost short term growth. Second, we need pro-growth economic policies and structural reform to provide the economy and financial markets an alternative to monetary policy to keep growth positive during a transition from a monetary policy led expansion to an economic fundamentals led expansion.

The present financial bubble is going to resolve itself one of two ways: the way it did during the Dot-Com bust or the 2008 Financial Crisis when financial markets imploded during a slowdown in growth and a modest tightening of monetary policy. or we will somehow escape the doom-loop of overly accommodative monetary policy leading to worse recessions which lead to even more accommodative monetary policy.

Within the US, we currently have most of the ingredients necessary to accomplish that transition. That does not mean we will successfully make the transition. It simply means that we have a better shot that we have had in a long time. Such a transition will not be smooth, nor has it been. But it is conceivable that if we survive the current volatility without reverting to bad policies or slipping into negative growth, we can end the Greenspan-Bernanke-Yellen era of bad monetary policy. That would give the economy, and by extension financial markets, something truly solid to build on for the first time in a long time.

P.S. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

I think financial markets have Nikkei 1989 written over them. BOJ owns greater than 50% of the Nikkei now (and its still down from its ATH nearly 30 years later), and nearly all the JGB’s. ECB owns 20% of the corporate bond market in europe, FED has ~$4T of gov bonds and MBS on their balance sheet. In econ, fundamentals aren’t fundamental, these aren’t laws of physics (which our understanding of is constantly changing), supply and demand is at work on “assets” (whose definition changes over time). Cheap money has made many assets become liabilities when money “suddenly” is no… Read more »

All good points and you may very well be right. Just because there may be a window of opportunity for the economy to transition doesn’t mean it will

Don’t get me wrong, I think there is a lot of opportunity out there and will remain out there, but I think it will require large investors to make smaller bets on lots of differentiated companies and finding ways to lower their overhead costs of managing that (time/money/effort) than by crowding into companies already addicted to ZLB. The types that want to cram everything into excel (that is no longer sufficient to operate at the scale or complexity needed) will get taken to the woodshed.