Submitted by Taps Coogan on the 12th of June 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

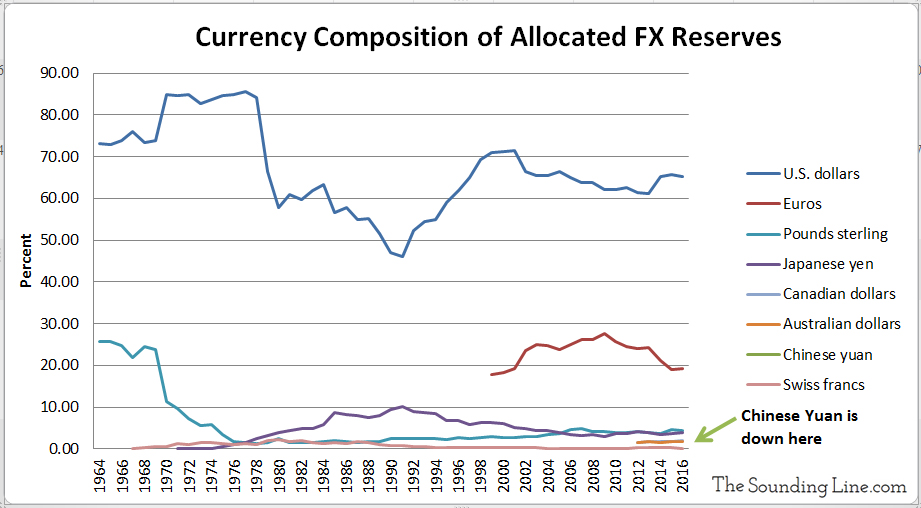

Despite the endless ‘Petrodollar’ collapse theories, allocated US dollar reserves have reached their highest percentage relative to total global foreign currency reserves since 2001.

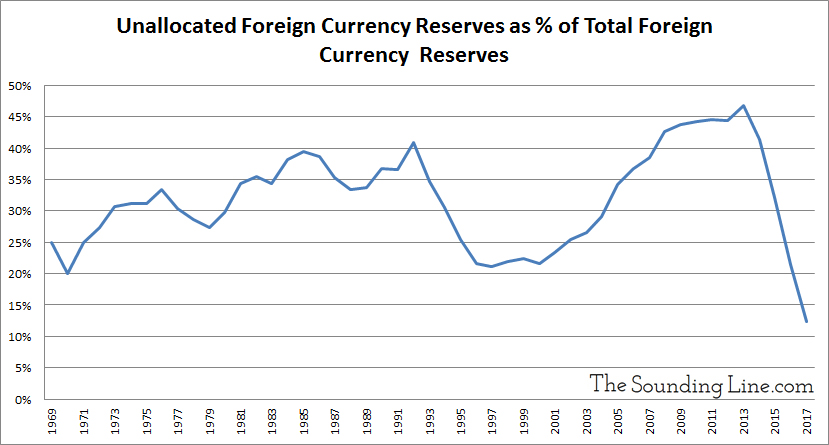

There are two types of foreign currency reserves: allocated and unallocated reserves. Allocated reserves are when a country specifies the underlying currencies of their reserves (US dollars, Euros, Chinese yuan, etc…) and unallocated reserves are when only the value of the currency is specified not the underlying currency itself. While some countries continue to maintain secrecy surrounding the composition of their reserves, the percentage of unallocated reserves has plunged in recent years as countries have increasingly disclosed their specific currency holdings.

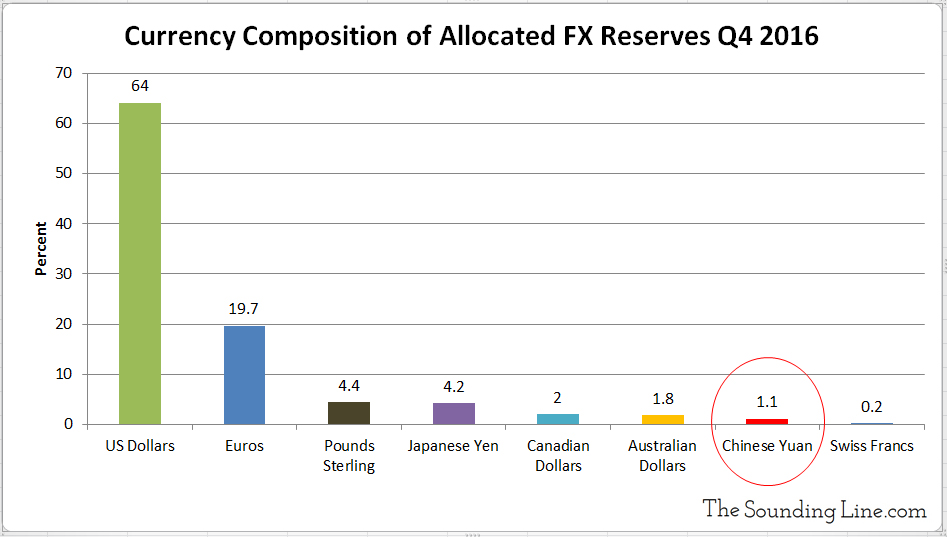

As we first discussed here, the US dollar represents over 60% of allocated reserves and has seen that percentage increase slightly in recent years despite the barrage of stories about the pending demise of the US dollar and the ascendency of the Chinese yuan. The Chinese yuan represented roughly 1.1% of reserves at the end of 2016 and 1.2% at the end of 2017. That is significantly less than the Euro, Pound Sterling, Japanese yen, Canadian dollar, and Australian dollar.

Since 2013, total foreign currency reserves have declined by roughly $250 billion and unallocated reserves have declined by $4.05 trillion. Meanwhile, US dollar reserves have increased by $2.47 trillion, indicating that over 60% of the unallocated reserves that became allocated since 2013 were denominated in US dollars.

To understand why the US dollar remains the reserve currency of choice, we previously noted the following:

Consider this: All of the oil exported in the world in 2016 was worth about $678 billion. Despite all that is written about the ‘Petrodollar’ system, oil represents less than 5% of the total global goods trade, which is estimated at over $16 trillion a year. The global goods trade is in turn a tiny fraction of the shares of US stocks transacted in a given year (roughly $60 trillion). The US shares traded in a year are in turn a fraction of the US treasury bonds traded in a year (roughly $125 trillion) and total US bond market transactions in a given year (roughly $190 trillion). All of this is a tiny fraction of the total currency transactions, which are some $1.825 quadrillion (that’s $1,825 trillion) a year!

While crude oil is a vital resource that many countries import, it’s size relative to the total goods trade and to financial markets has been greatly misconstrued.

Reserve currency preference involves much much more than the pricing of oil or other trade goods. Countries decide which currency to hold in reserve based on: the easy, fair, and liquid convertibility of the currency, access to the deepest debt and financial markets denominated in that currency, free and unimpinged capital flows, the issuing country’s legal framework, and the currency’s stability. It is more likely that the 200 plus independent countries involved in exporting, importing, and/or refining oil products prefer to use US dollars as a medium of exchange because the US dollar is preeminent in the much larger financial markets from which oil payments are drawn than the reverse.

Nations are not going to denominate the majority of their reserves in Chinese yuan so long as the Chinese maintain a ‘closed capital account,‘ arbitrarily restricting the conversion of the yuan into other currencies, the flow of capital in and out of China, and pegging the value of the yuan to the US dollar. So long as the financial markets in which reserves are actually used are overwhelmingly denominated in US dollars, the US dollar is likely to remain the world’s preferred reserve currency.

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

To be meaningful, shouldn’t the US’s 20+ trillion debt be taken into account? Am I missing something?

Paradoxically, it is the depth of the US debt markets that make the US dollar a suitable reserve currency. So long as the US continues to service its debt at least.

Also keep in mind that China borrows as much as the US:

https://thesoundingline.com/shock-the-chinese-government-likely-borrowed-more-than-the-us-in-2017/

quadrillion in forex? Per year? Doesn’t this dwarf all currency reserves? It seems at this rate big changes could happen in one year.

Yes it does dwarf currency reserves but keep in mend that its transactions vs a balance. Nonetheless, currency reserves are too low in most countries.

In fact, world currency reserves are less than 12 trillion. Last year, the share in dollars was at a four year low. I think this could be very, very volatile. Having a high share of reserves in dollars today doesn’t mean much if the pendulum begins to swing.