Taps Coogan – December 9th, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

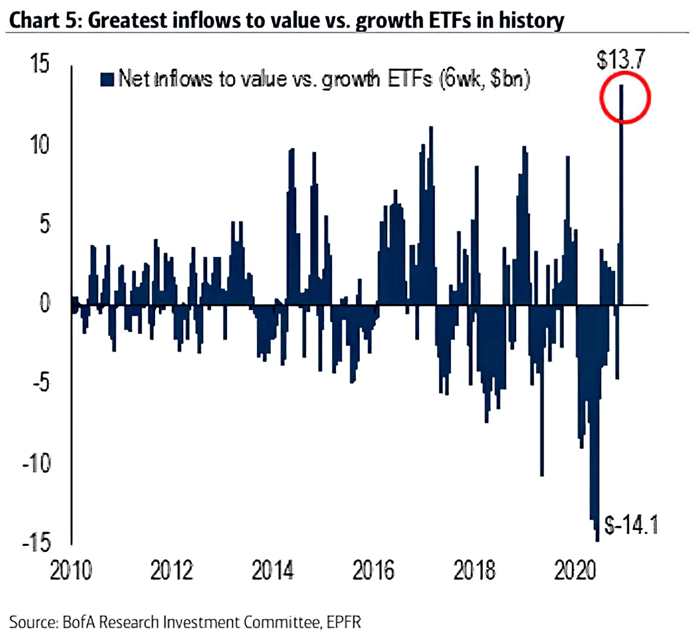

The following chart, from Bank of America and via ISABELNET, shows that we have swung from the largest relative inflow of capital into growth ETFs compared to value ETFs only to be followed a few months later by the exact opposite.

The historic swing from ‘growth’ during the worst parts of the pandemic to ‘value’ once a vaccine started looking more likely points to something we have noted a few times. ‘Growth’ has become bet on the rarity of structural growth whereas ‘value’ has become bet on broad, cyclical growth. In that backward dynamic, the worst thing that could happen to ‘growth’ stocks with historically high multiples could very well be an economic recovery.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.