Taps Coogan – July 23rd, 2021

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

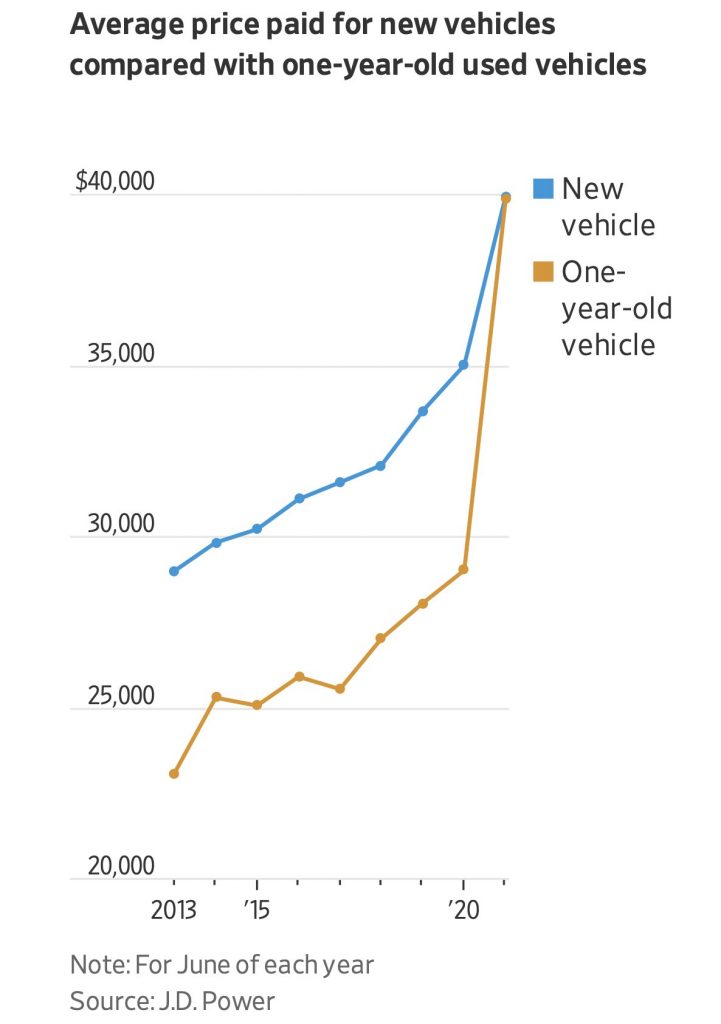

The massive rise in used car prices has attracted a lot of press since it kicked off last June. As the following chart shows, from the Wall Street Journal via ACEMAXX ANALYTIC, one-year-old used cars are now selling for the same price as new cars, and that’s despite a big jump in new car prices.

The proximate cause of the rise in new and used car prices is said to be a shortage of semiconductors needed to manufacture vehicles. That has hit at the same moment that consumers, flush with stimulus money, have rushed out to buy vehicles at seemingly any price. Car rental companies, which liquidated their inventories during the Covid lockdowns, are also rushing back to buy cars en mass.

So yes, the very recent surge in new and used car prices has a large ‘transient’ component that should improve with time.

However, auto prices have been surging for years, albeit at a somewhat slower pace than since Covid. What’s the bigger picture?

Despite all the focus that gets placed on the tendency of low interest rate policy to boost financial asset prices, the dynamic applies to the price of anything bought on credit, including autos. The lower the interest rate, the more car you can buy for the same monthly payment.

Of course, that kind of price increase is conveniently stripped out of CPI and PCE inflation calculations via hedonic quality adjustments. The Fed claims there was about 1% auto inflation for the entire period of 1996 to 2020 and less than 5% since Covid. No that is not a joke.

Meanwhile, the average price paid for a new car has risen by nearly 50% since 2013. That’s largely because falling interest rates have enabled consumers to buy cars they otherwise couldn’t have bought. In a sense, the Fed is technically right. Much of the rise in prices is not due to consumer price inflation, at least not the way they define it, but due to more expensive taste, enabled by low rates. The average new car sold now costs a stunning $40,000.

With more and more things being bought on credit (TVs, phones, computers, education, appliances, clothes, even food) the entire paradigm of ‘consumer price inflation’ and its emphasis on stripping out quality improvements, makes it irrelevant. The price level of consumer goods, like financial assets, is becoming more and more dependent on interest rates. In other words, the entire economy is becoming a leveraged bet on monetary policy and the Fed has intentionally blinded themselves to the dynamic.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.