Submitted by Taps Coogan on the 29th of November 2017 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

Recently, we performed an analysis of the inflation adjusted GDP growth of nearly every country in the world since 2000 and came to the sobering conclusion that several Eurozone economies were among the absolute worst performers.

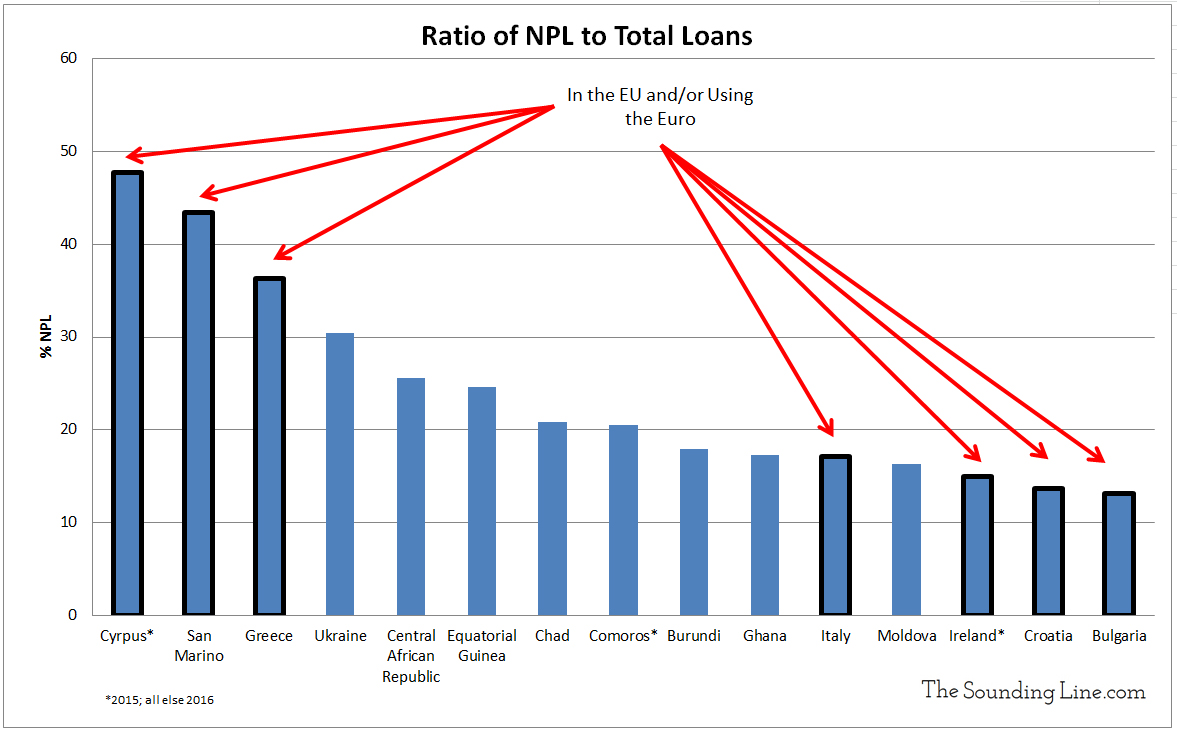

Along similar lines, we have looked at World Bank data on the ratio of non-performing loans to total loans for 216 countries and independent sates around the world in order to determined which countries’ financial systems are weighed down with the highest concentrations of bad debt.

As you may have guessed from the title of this article, a staggering seven of the 15 worst performing countries in the world can be found in the EU and/or using the Euro (Cyprus, Greece, Italy, Ireland, Croatia, Bulgaria, and San Marino which technically isn’t is the EU but still uses the Euro). Six of the 15 use the Euro, and nine of the 15 are in Europe. The remaining six countries are in Africa and are, with the exception of Ghana, some of the poorest, most under-developed in the world.

When one considers that the Eurozone has not created any net employment since 2008 despite its population growing by over six million people, that Greece is experiencing a slower economic recovery than the US did during the Great Depression, that several Eurozone countries have seen little or no inflation adjusted growth since the implementation of the Euro, that those countries in Europe that first adopted the Euro have seen the slowest growth in Europe, and that several have the highest ratios of bad debts in the world, it becomes clear that the Eurozone economic experiment has been a failure, at least for Southern Europe.

Perhaps what is most amazing about the whole affair is that it has gone on as long as it has without more significant political ramifications. That now may be changing and Eurozone voters appear to be wising up.

If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Is this article unifished? It does not discuss the problems of these 15 countries and what will next for them? Its why we readers are here you know.

Jimmi, this article is to point out the magnitude of the problem. Many are unaware of just how bad the economy in Southern Europe is. I discuss the underlying issues in detail in many of my posts. Maybe these posts will answer some of your questions:

https://thesoundingline.com/taps-coogan-this-is-the-ecb-and-bojs-nightmare/

https://thesoundingline.com/taps-coogan-italy-has-99-problems-austerity-isnt-one/

https://thesoundingline.com/taps-coogan-ecbs-balance-sheet-has-outgrown-the-eurozone-three-years-running/

https://thesoundingline.com/italian-debt-crisis-central-bank-is-the-only-major-buyer-of-italian-debt/

https://thesoundingline.com/map-of-the-day-the-unemployment-rate-in-every-region-of-europe/

https://thesoundingline.com/where-workers-pay-the-highest-income-tax/

https://thesoundingline.com/southern-europe-has-not-seen-net-job-creation-in-over-a-decade/