Taps Coogan – December 31st, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

With 360 articles and nearly 6,000 Top News Stories published, 2022 is in the books here at The Sounding Line.

Thank you very much for your readership and a special thanks to those who donated! Your support is much appreciated. Thank you as well to the many websites that share our articles!

As always, if you would like to be updated via email when we post a new article, please click here. It’s free.

With no further adieu, here are my favorite charts from this strange year.

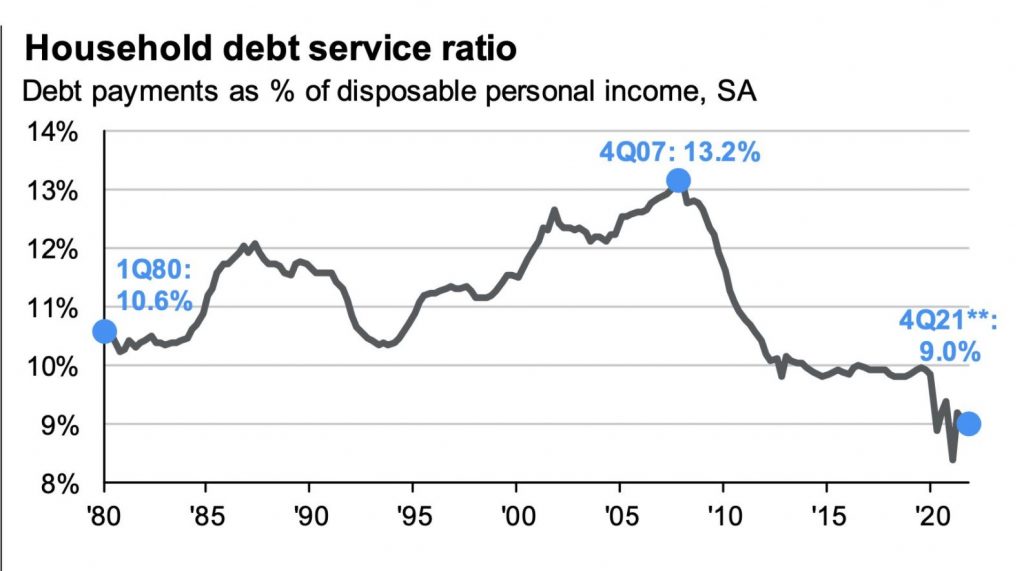

1.) We started the year with record low household debt servicing costs thanks to last year’s absurdly low interest rates and free-money giveaways. We’re only in the first inning of a major default cycle.

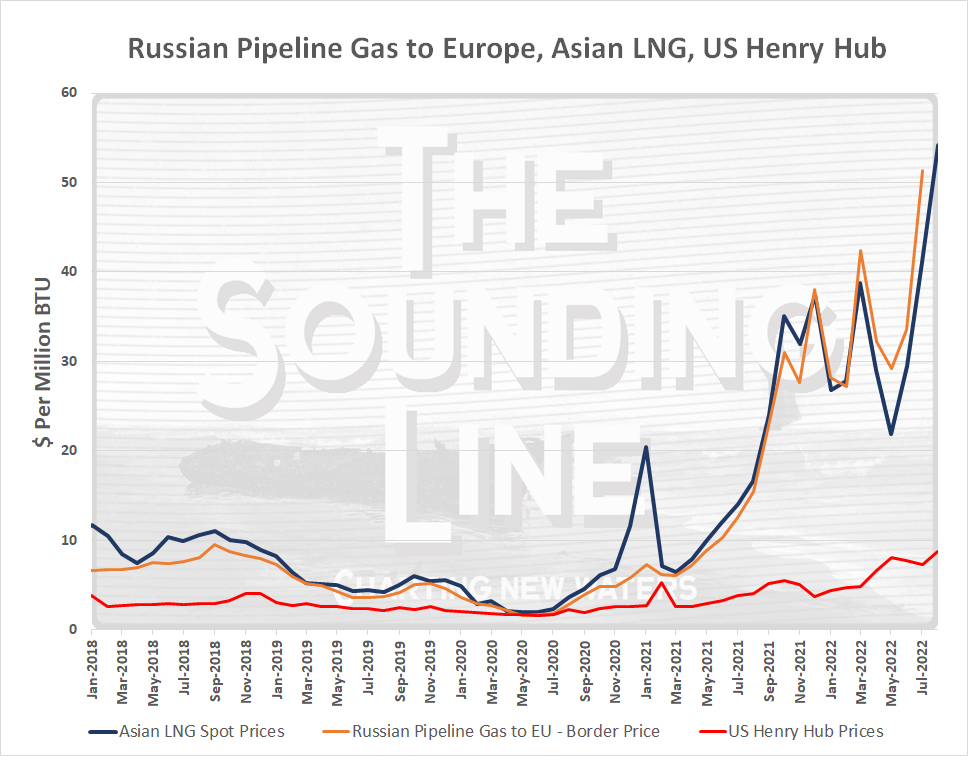

2.) Enough with the narratives. Russian natural gas exports to Europe were never cheap. Europe should have started building more LNG import capacity years ago. European gas was very expensive before the Ukraine War.

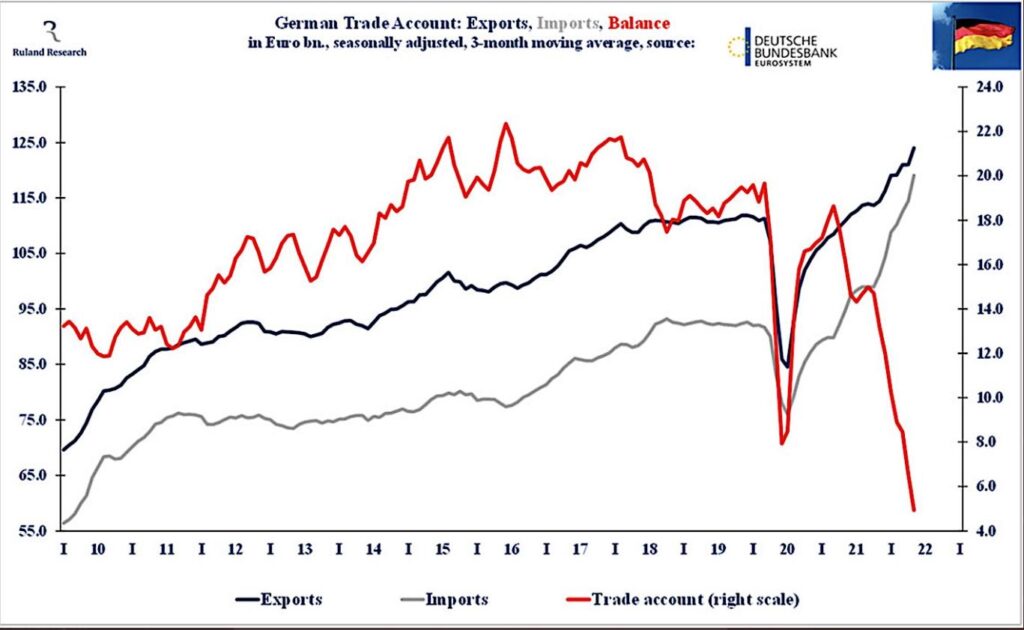

3.) Thanks to the ‘Energiewende’ and a ‘Russia-only’ energy strategy, Germany no longer runs a trade surplus.

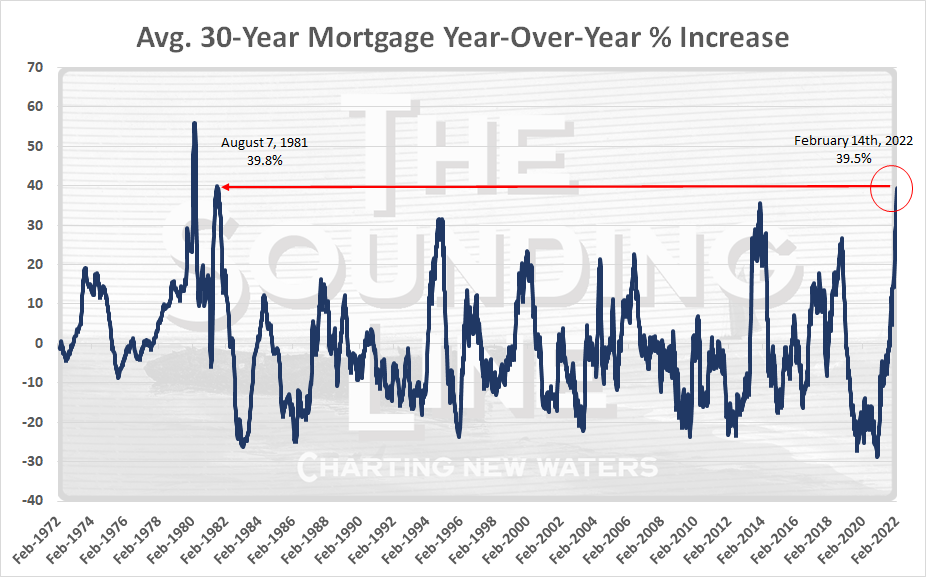

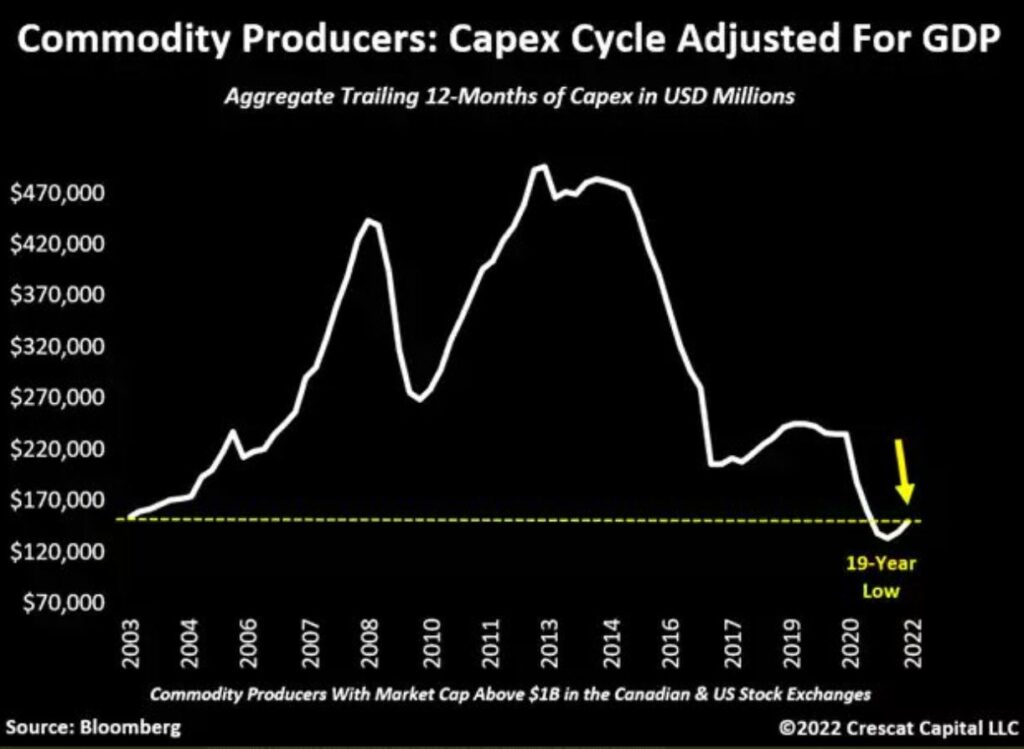

4.) US mortgage rates spiked at the fastest pace since the early 1980s.

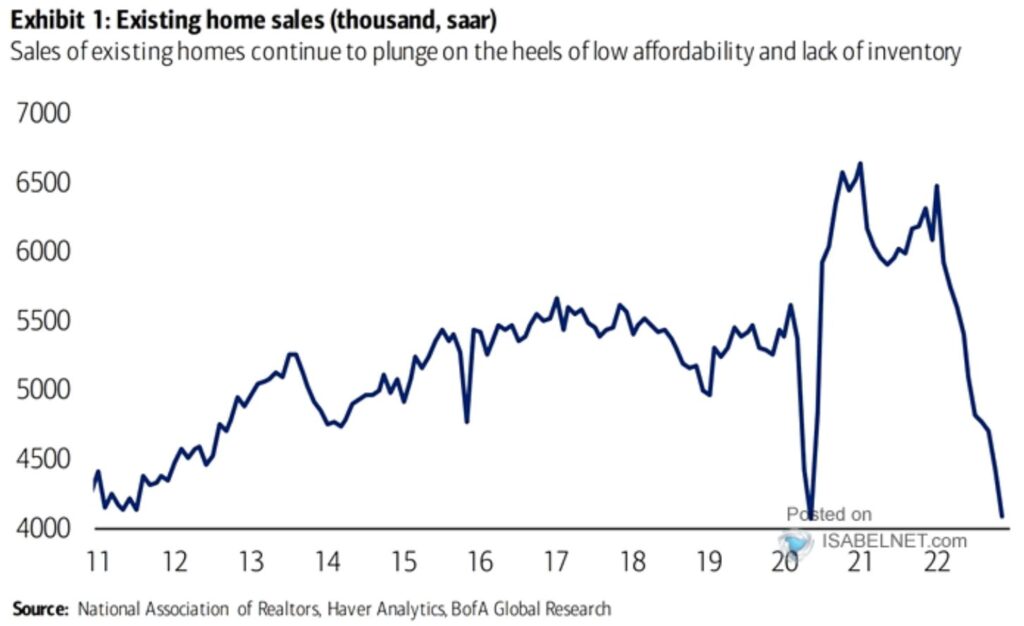

5.) Not too surprisingly, home sale are imploding.

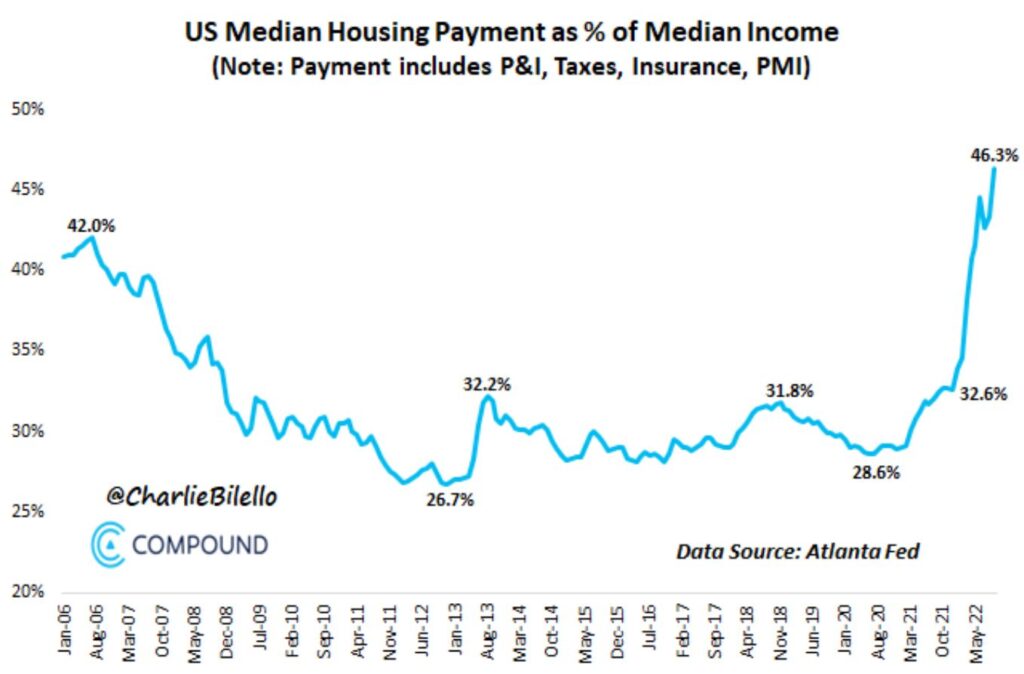

6.) Housing is basically the least affordable it’s ever been. We’re heading for a major housing recession.

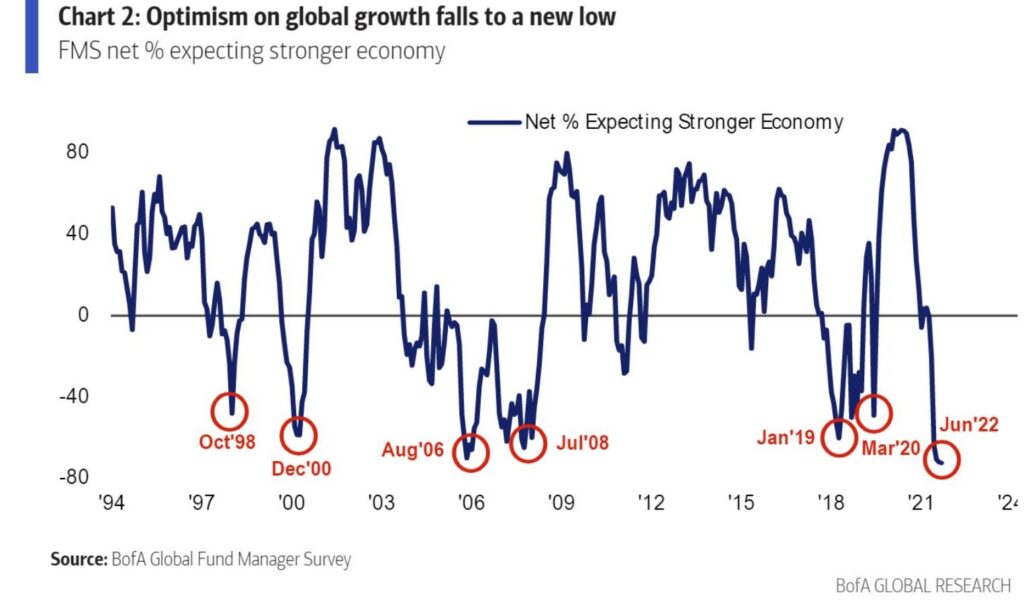

7.) Every leading indicator under the sun is pointing to a global recession. Meanwhile, central banks are still slamming on the brakes. This is not going to end well.

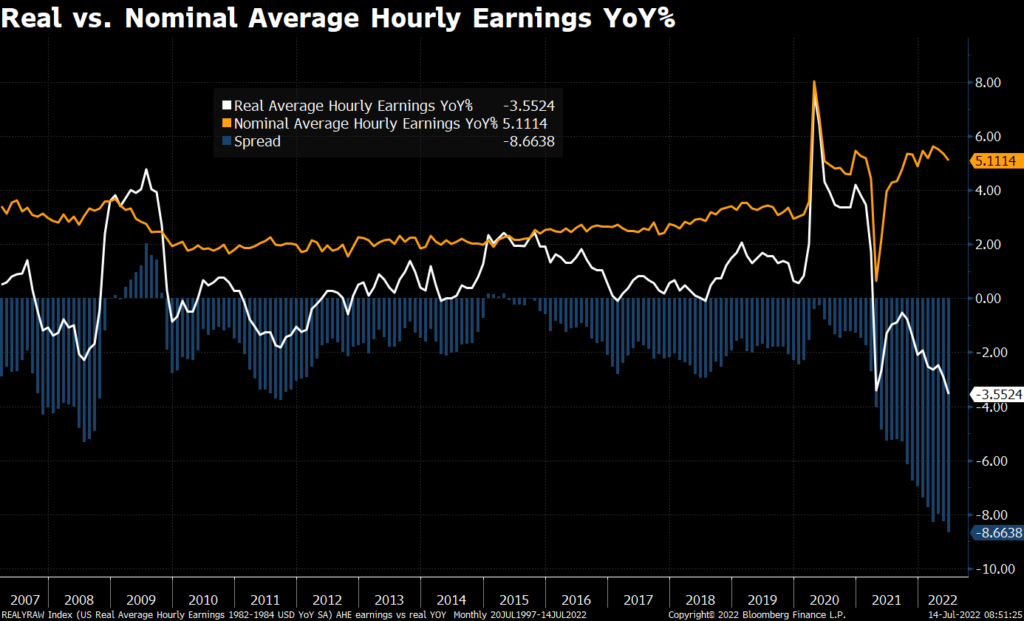

8.) You probably took a pay cut after inflation in 2022.

9.) Everyone and their dog is expecting a recession.

10.) Because everyone and their dog is predicting a recession, commodity producers are still resisting the urge to meaningfully expand capex. It’s hard to blame them.

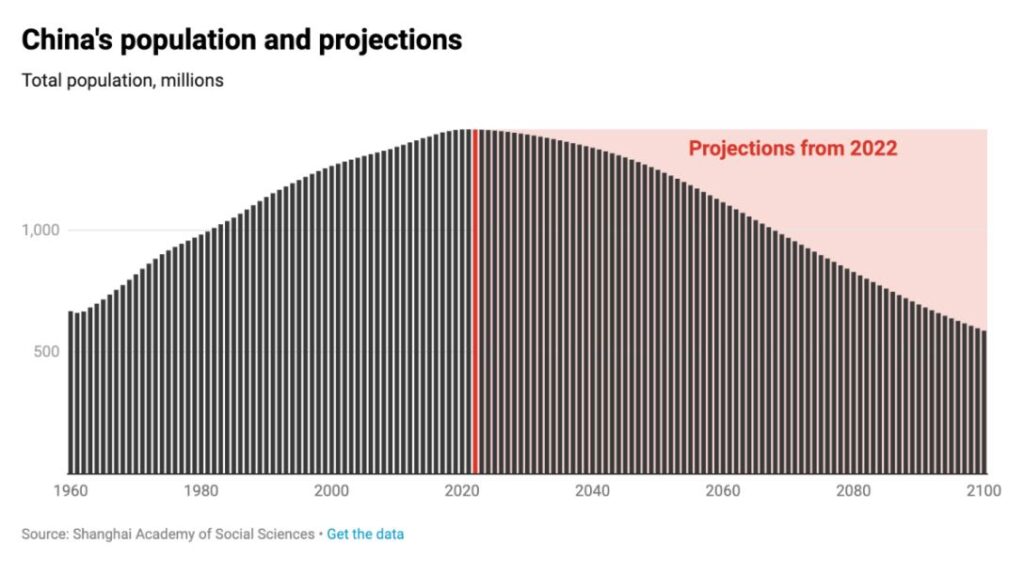

11.) China’s population peaked for good. It’s economy probably did too.

12.) 2022 was the worst year on record for a 60/40 portfolio. That includes 1929, 1930, and 2008.

As I sit on the cusp of 2023, I find myself entertaining two questions:

If a recession is so obvious that literally everyone sees it coming, is it already priced in?

If resource companies refuse to increase capex because of a pending recession, and the recession happens, do commodity prices still go down?

Best of luck in the new year.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

I was just checking out Zillow for shits and giggles…..well there was no giggling more like shock and awe….. and based on the prices “near me” and having looked up media household income and compared it to the average home price the “house payment as % of median income” comes in at:

73%

Edit: not Average home price just a random middle range home on my list. Many are quite higher than the one I used to get this %

The degree to which declining mortgage rates caused rising home prices is wildly underappreciated. Strap yourself in.

I was doing a little more research since escaping California is quickly becoming my top priority. Saint George UT, a place I’ve been thru many times, quaint little town as I remembered it. Did a Zillow search, the RE prices are OBSCENE. I’m in utter disbelief. The area media household income is ~$61K and the area is chock full of $1,000,000 homes. I found a couple in the hi $300K to low $400K range. So then I figured lets see what kind of help wanted jobs there are available. Almost NOTHING but fast food, home depot and Lowes jobs…. WTF… Read more »