Submitted by Taps Coogan on the 20th of July 2018 to The Sounding Line.

Enjoy The Sounding Line? Click here to subscribe for free.

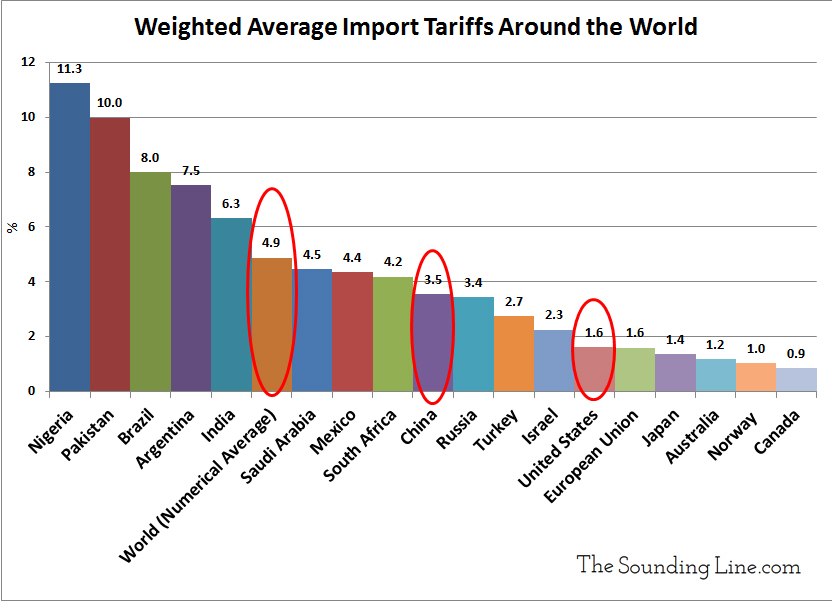

In light of the ongoing trade tensions between the US and China, we previously published the following chart which shows the weighted average import tariffs of major economies around the world. We pointed out that China’s weighted average import tariffs were nearly twice as high as in the US, a reality that contributes significantly to China’s massive trade surplus.

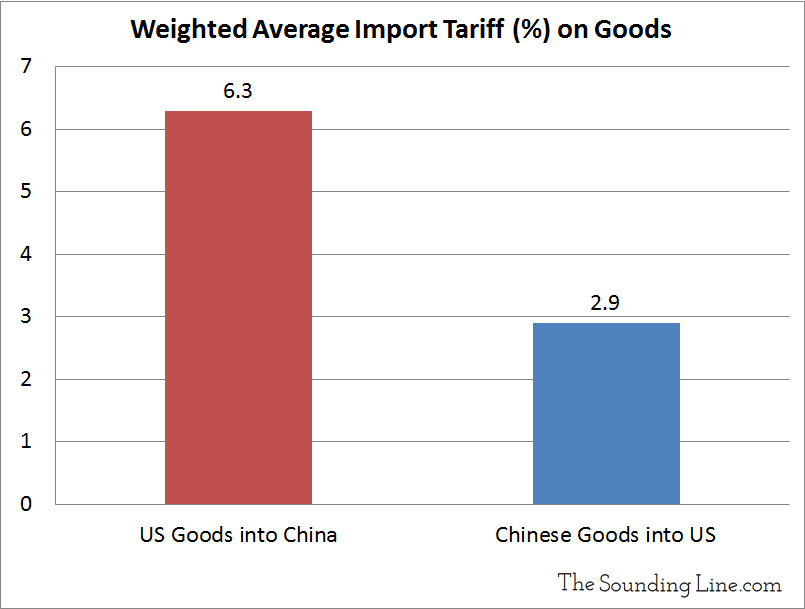

However, the truth of US-China tariffs is actually much worse. Because different types of goods incur different tariff rates, and because China has different trade arrangements with different countries, there are large differences between the weighted average tariffs that China applies to imports from one country versus another. If one looks specifically at the weighted average import tariffs applied by China on imports from the US, and vice-versa, the situation is even farther out of balance. As the following chart shows, China’s weighted average import tariff on goods from the US is a whopping 6.5% compared to 3.5% overall (based on the most recently available data from 2016). On the over hand, the weighted average import tariff in the US on goods from China was 2.9% compared to 1.6% overall. In other words, Chinese tariffs are more than two times higher on US goods than vice-versa.

In addition to the high tariffs on US exports to China, China imposes tough regulatory hurdles, forced technology transfer requirements, and performs rampant IP theft.

After having benefited from such an unbalanced trade landscape for so long, China has few good options to retaliate against US pressure for fairer trade. Trade with the US is more important to China’s economy than vice-versa and the massive trade deficit and lower initial tariffs mean that the US will always be able to apply more tariffs than vice-versa. Even China’s holdings of US Treasuries, and the threat that they could sell them, have been exaggerated. China owns 5.5% of the treasury market, hardly a point of overwhelming leverage. China’s threat of boycotting American brands rings hollow too. Chinese restrictions on US brands doing business in China, as well as previous boycotts, has led most of them to partner with Chinese state-backed firms. A boycott on the American brand means a boycott on the Chinese state-backed firm. The products are typically made in China and many brands, including McDonald’s, don’t even own a majority stake in their Chinese namesakes. On top of all of that, Chinese financial markets are proving more susceptible to fears over a trade war than the US markets.

Given all of this, the best way to avoid a worsening of trade tensions would be for China to provide fairer access to its market.

Revision: A previous version of this article incorrectly stated that the Chinese weighted average tariff on US imports was18.85%, the third highest of any exporter to China. This was the result of a data handling error and has been corrected in the current version of the article. My apologies for any inconvenience.

P.S. We have added email distribution for The Sounding Line. If you would like to be updated via email when we post a new article, please click here. It’s free and we won’t send any promotional materials.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

A question, does the World Numerical Average change when volume of trade for each of the countries is taken to account?

Thank for the question. Yes it would change. To calculate the world numerical average I did a simple average of the weighted averages of each country.

If you did a weighted average of the weighted averages you would get yet another number. It would also be interesting. I’ll keep it in mind for a future post