Taps Coogan – January 14th, 2023

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

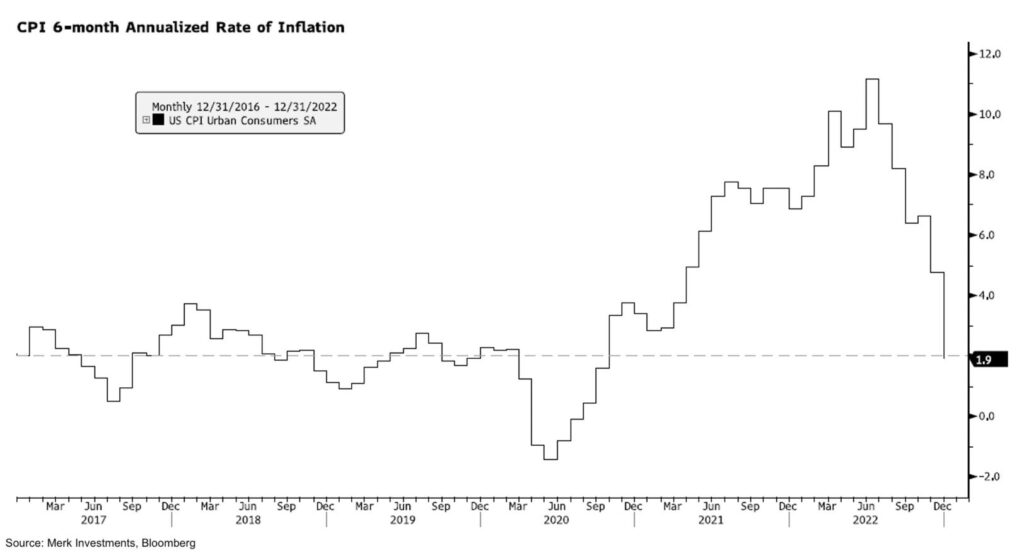

The following chart, via Nick Reece, shows that the 6-month headline CPI rate is now just 1.9%, down from over 11% last summer.

As we’ve been warning since at least early 2021, long before the Fed started tightening, the Fed would end up over tightening.

All of the leading indicators of inflation that we constantly talked about in late 2020 and 2021, the indicators that pointed to higher inflation (here, here, here, here, here, here, here, here, etc…), now point to disinflation. Shorter term measures of CPI, like that shown above, are already below the Fed’s 2% target and usually lead the widely referenced year-over-year number.

The irony of the Fed’s crusade to see how high they can get rates before blowing everything up is that it is going to ultimately lead to a return to excessively accommodative policy.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Really?,…… “the time to pause was 2 months ago”. Let’s do a thought experiment: [What would be the lending rate currently be if it were determined by a free market? Given contemporary money supply, worldwide central bank policy, likely unpayable levels of private and public debt levels…..what “rate” would you charge for loaning out your own personal money to the economy at large? I bet it would be more that 4%. Personally, I wouldn’t loan at any rate but might foolishly waiver at 50%] IMO, the Fed rate should not be determined by what best juices the economy. Loose Fed… Read more »

The Fed funds rate is the (annualized) rate for a fully collateralized 1-day loan.

The question is not whether we want market determined rates or what they would be in some entirely hypothetical scenario where everything is different. The question is whether the Fed continuing to hike interest rates in the world we actually live in will provoke a more severe recession that will lead to rates that are lower, in the long run, then they would be if they pause for a bit.

I thought the Fed Mandate was currency integrity and “fullish” employment. No where do I see “ rates that are lower, in the long run, then they would be”.

The end game should be a free market, in which free and transparent price discovery is obtainable by the average citizen. Such a régime would best support currency integrity and full employment. Yes, there would be pain between here and there.

But we only have ourselves to blame for that pain. And honestly, the pain is unavoidable. It is only a choice of how delayed it will be, and in how painful.

Taps, do you have an update on your thoughts in light of the current jobs data and hiking trajectory? Is Powell managing to do the unthinkable…..finessing a “soft landing”?

My opinion is a “hard no”, but I am interested in your thesis as events declare themselves. The present time feels like that weird moment in 2001 when a quiet lull in the news cycle, shark stories filled the void in anticipation of something “big” about to happen. Chinese balloons and cooked employment #’s are giving me the same vibe….something wicked this way comes.

I’ll try and write an article to give a full answer. I am operating on the assumption that we are going to have a traditional labor market and earning recession beacuse thats what the leading indicators suggest. Labor statistics are badly lagging indicators and shouldnt be used for forward looking statements. Nonetheless, I find the widespread expectations of a recession to be a good thing. The whole doom and gloom thing has gotten so wildly excessive in the past years that I find it intellectually lazy at this point.

I don’t understand any of this, I really don’t. I’ve been in recession for going on 25 years and inflation according to the chapwoodindex, a MUCH BETTER read on the inflation IN MY WORLD, is running at an ~11.7% average.

A STARTER HOME IS $1,000,000

“investors” and the “market” cough cough cough “casino” want the free money to never end.