Taps Coogan – December 31st, 2020

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe.

With 445 articles and roughly 5,500 Top News Stories submitted since the start of the year, 2020 is officially coming to a close here at The Sounding Line. It’s been a pleasure writing and curating the news for you during this bizarre year. Thank you very much for your readership.

I would also like to extended a special thanks to the readers who have donated to The Sounding Line this year. Your support makes a world of difference. Thank you as well to the numerous websites that have shared and linked to The Sounding Line articles this year. In particular, thank you to 321Gold and Bacheimer for being top independent website referrers.

We are trying to grow the readership here at The Sounding Line, so please consider recommending the site to a friend or our sharing articles online. As always, if you would like to be updated via email when we post a new article, please click here. It’s free.

With no further adieu, here are my favorite charts from 2020, in no particular order:

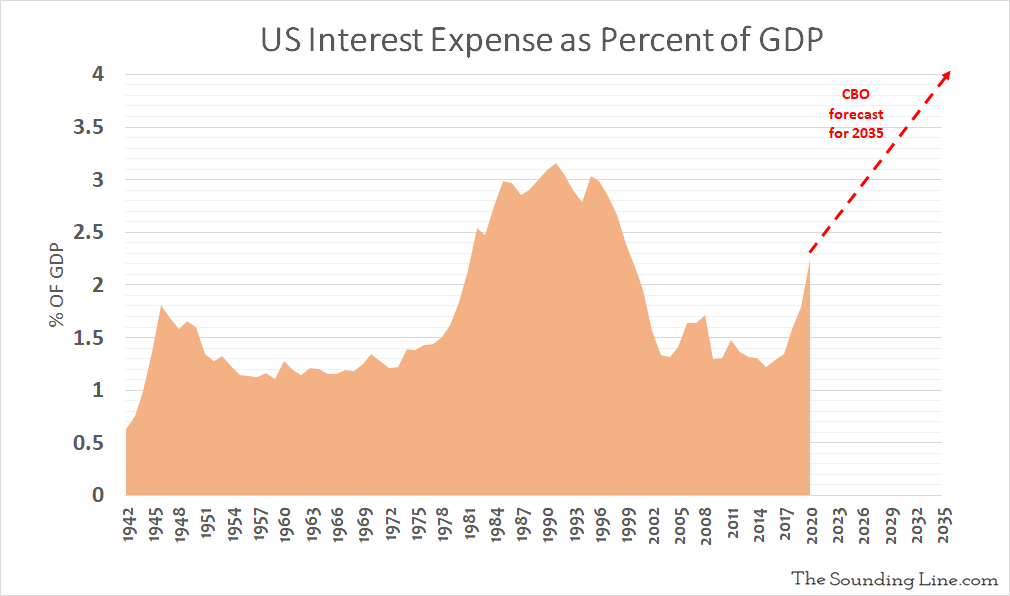

1.) Back in January, before the pandemic/lockdown recession began, the interest expense on the national debt was increasing at the fastest pace on record. It was also the fastest growing major category of federal spending. At the time, the CBO was forecasting that the interest on the national debt would hit a record 4% of GDP by 2035 (more than military spending). Since then, the national debt has increased by roughly $4 trillion. The increase in new debt (a roughly four fold increase in annualized debt) is outpacing the fall in rates on new debt (which have roughly halved), so however bad the outlook was in January, it is much worse now.

2.) As the following chart from June highlights, the increase in unemployment caused by the pandemic/lockdown is genuinely unprecedented in modern times:

May Employment Report: 2,500,000 Jobs Added, 13.3% Unemployment Rate https://t.co/sYZ0uXqOHu pic.twitter.com/qDVrOHsPUl

— Bill McBride (@calculatedrisk) June 5, 2020

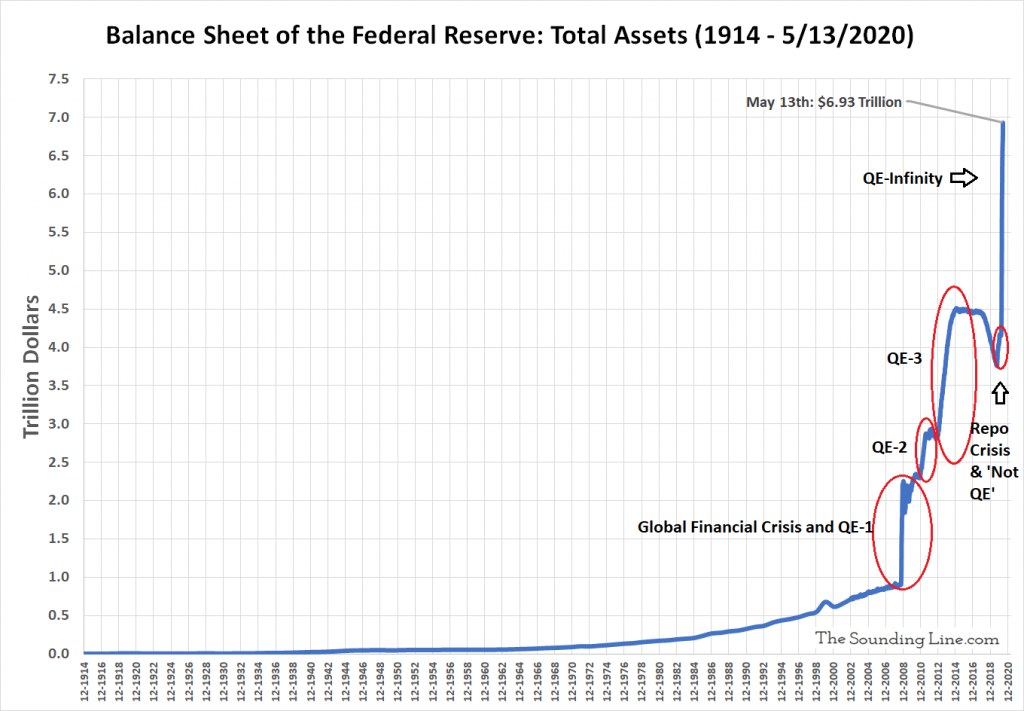

3.) By mid May, the Fed’s QE-Unlimited program had already surpassed all prior QE programs combined. Since then, the Fed has monetized another half-trillion dollars with no end in sight.

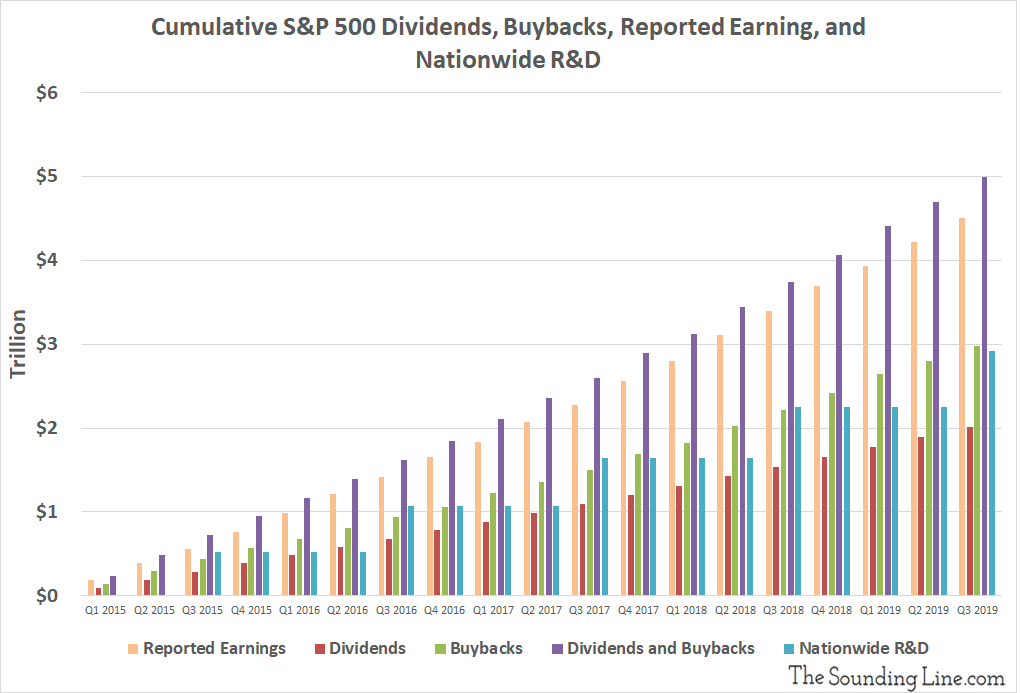

4.) From 2015 through 2019, S&P 500 companies collectively spent more on buybacks and dividends than they earned. They also spent more on buybacks than the entire US invested in R&D. This year the Fed and Congress handed Wall Street the biggest bailout in American history.

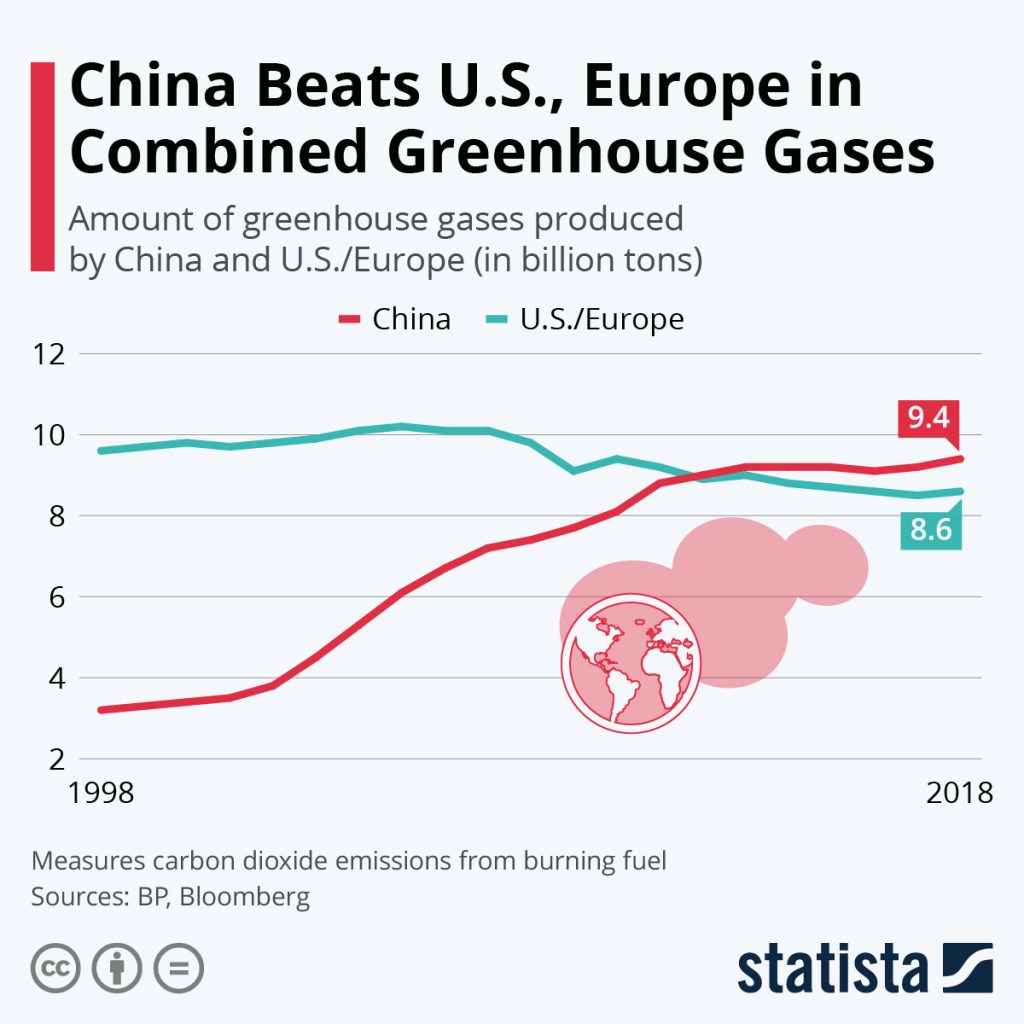

5.) Despite endless apocalypse-mongering, US CO2 emissions fell to new lows in 2019 (before the historic decline this year) and have fallen roughly 20% since 2007, inline with reductions in Europe despite much less regulatory zealotry. China now emits more than the US and Europe combined.

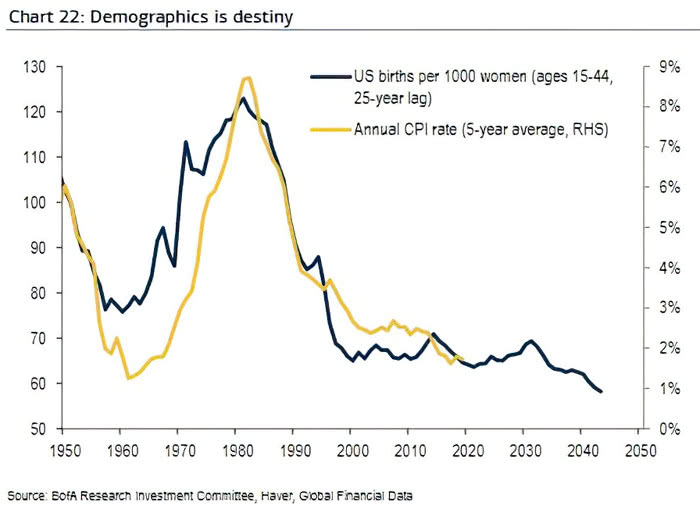

6.) Demographics may be destiny, but that won’t stop the Fed from hijacking financial markets in a bid to meet its inflation targets.

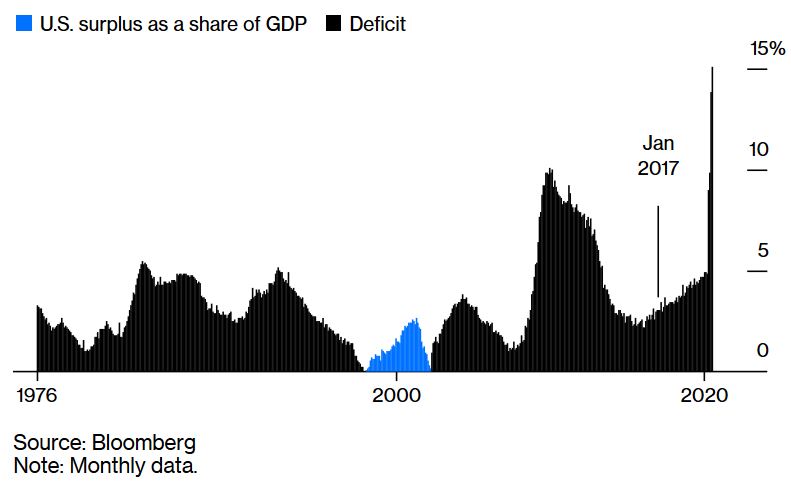

7.) Back in August, the US budget deficit hit its highest level relative to GDP since the peak months of World War II. It’s now late December and trillion dollar stimulus bills are still snaking their way through Washington.

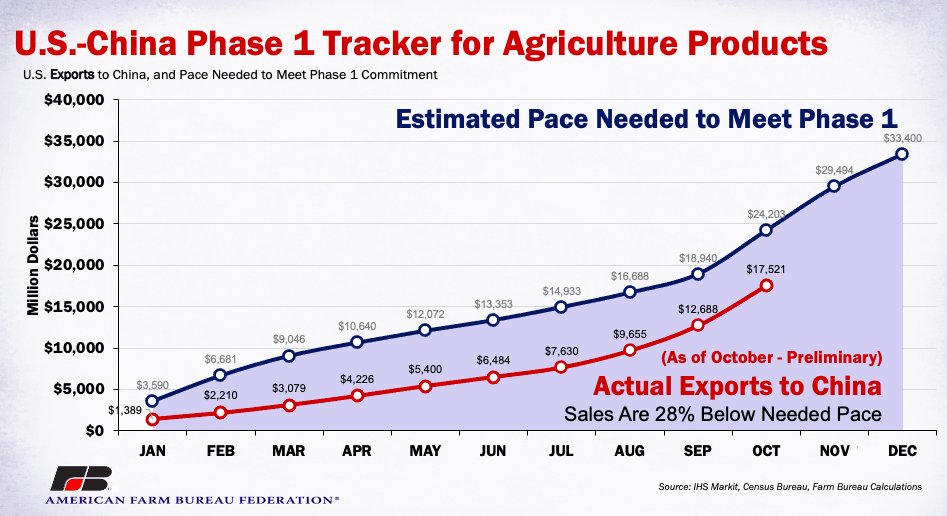

8.) Add the ‘Phase One China Trade Deal’ to the list of international treaties and deals that the Chinese signed and then immediately disregarded. Chinese imports of American agricultural products are lagging their commitments by roughly half. This occurs against the backdrop of China’s overall agricultural imports surging this year and it’s imports from Brazil jumping 22%:

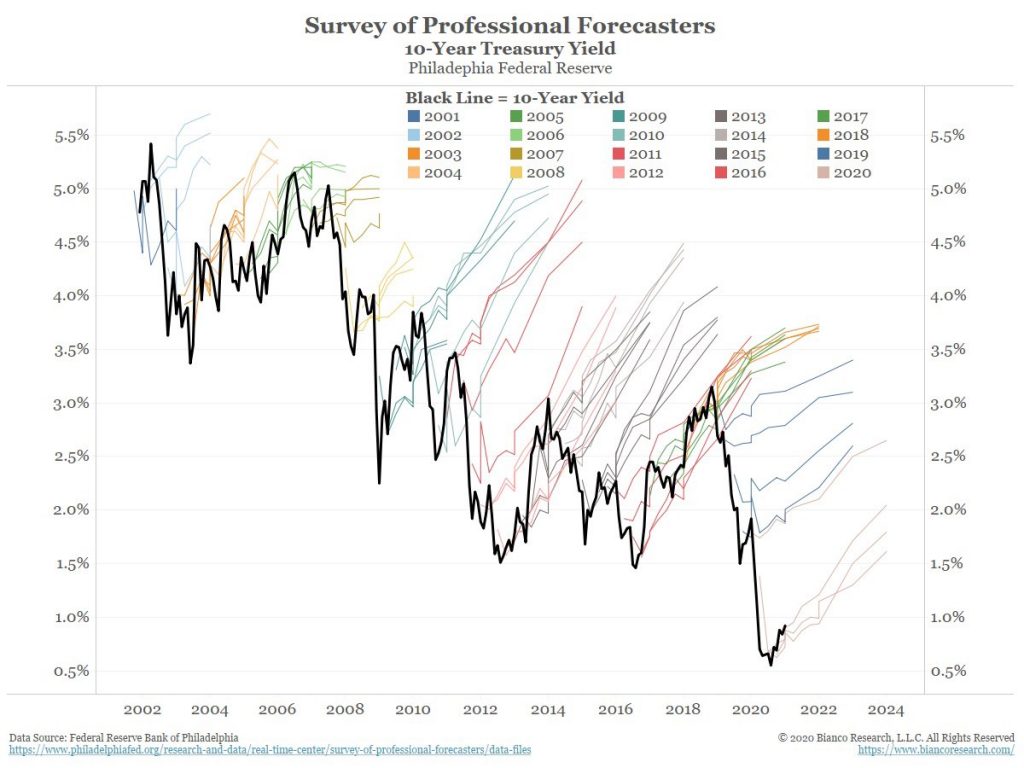

9.) Just a reminder, consensus economic and market forecasts are worthless:

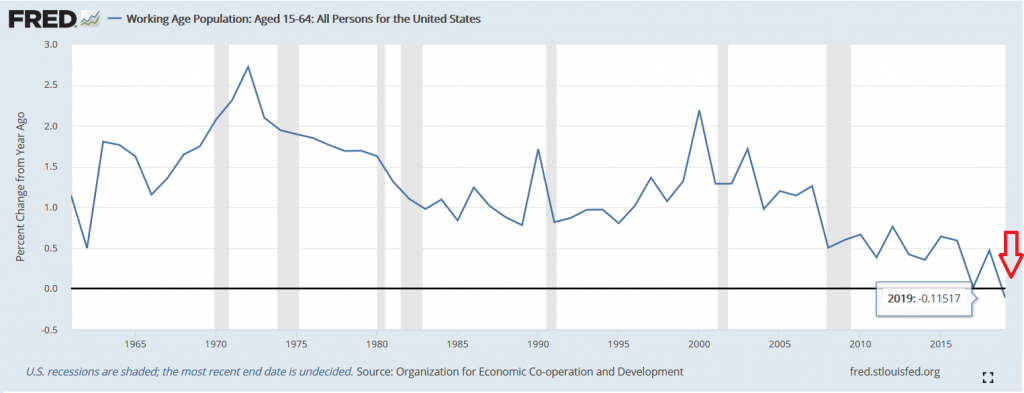

10.) The US working age population is now shrinking for the first time on record, a terrifying harbinger for a country taking on trillions of dollars of new debt every few months.

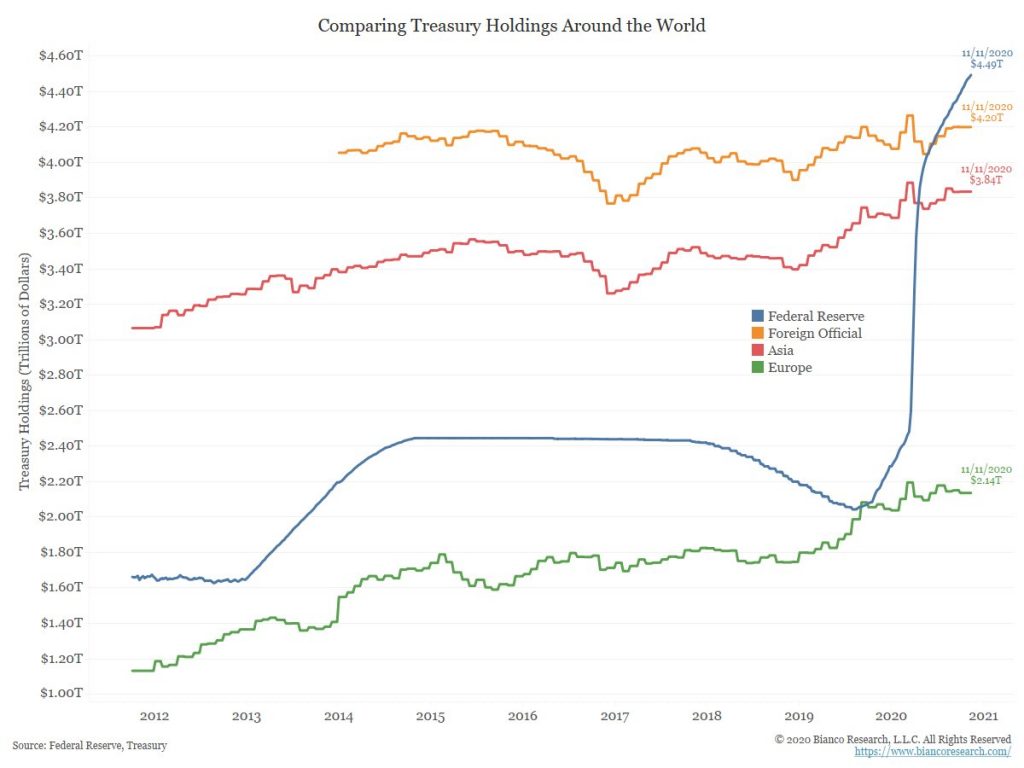

11.) Thanks to QE-Unlimited, the Fed now owns more Treasuries than all foreign central banks combined.

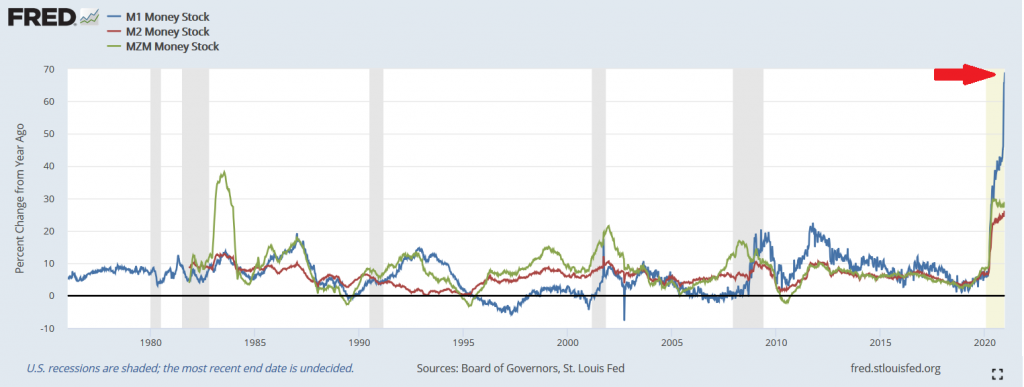

12.) The various measures of money supply growth are surging to never-before-seen highs. Prior QE programs never accomplished anything resembling this level of liquidity creation.

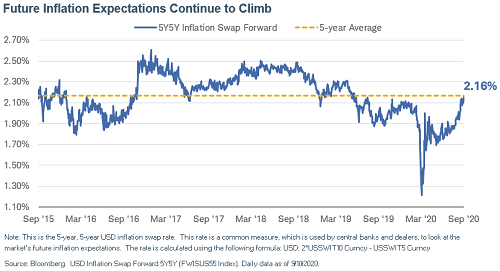

13.) While the Fed drones on about dis-inflation, market implied inflation expectations for the next five years are already higher than before the pandemic/lockdown recession started.

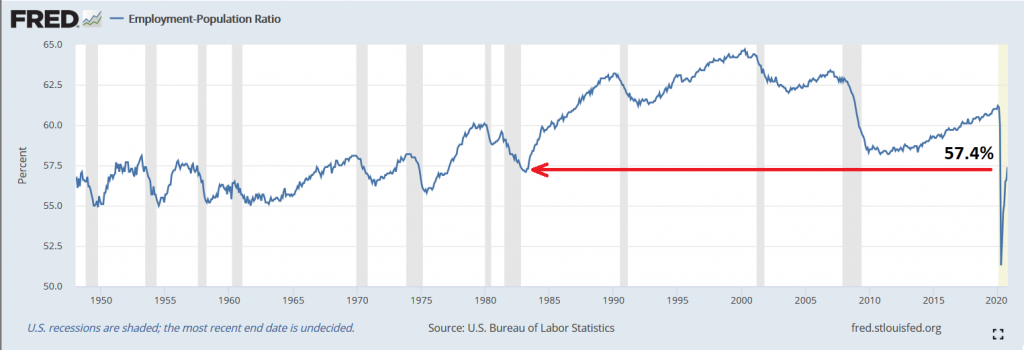

14.) Barely half of Americans have jobs:

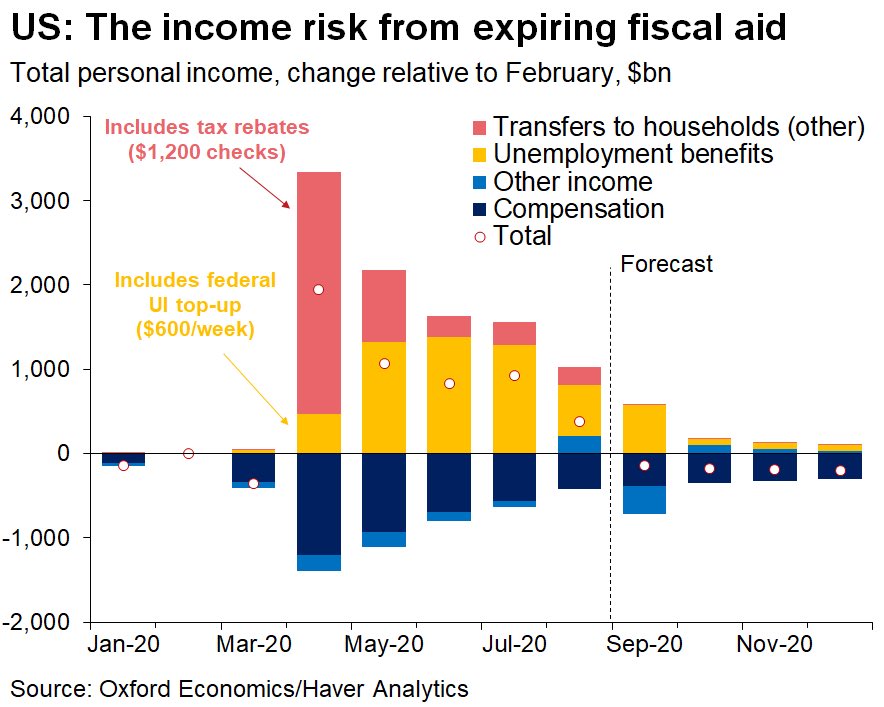

15.) This was the first recession on record where average personal income actually rose. It’s a result of government transfer payments:

16.) It may be the end of the world as we know it, but apparently that’s bullish for stocks:

Here are my favorite charts from 2019, 2018, and 2017. Best of luck in the new year!

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free. Also, please consider sharing this article so that we can grow The Sounding Line!

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.