Taps Coogan – January 13th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

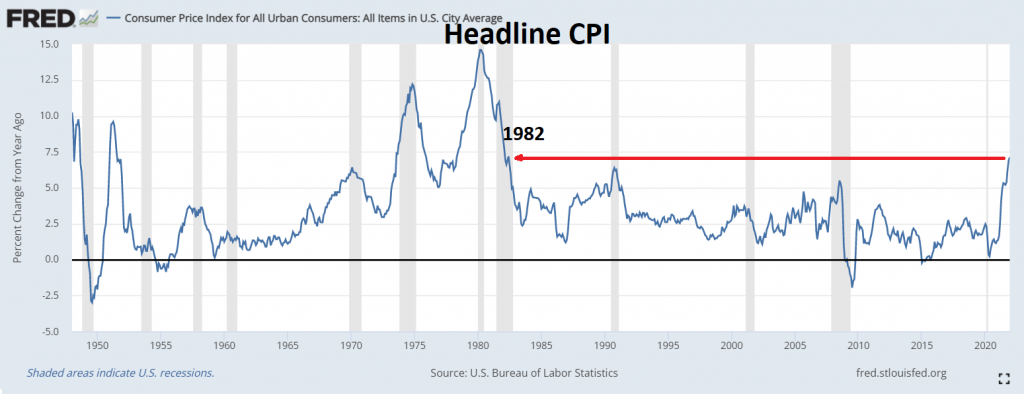

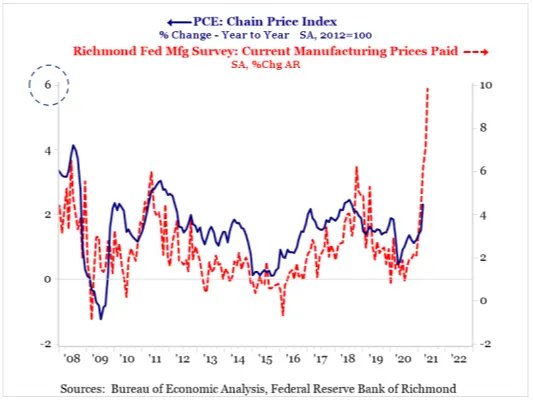

Yesterday’s hot CPI release officially brought headline CPI inflation to 7% for December and 4.7% for 2021 as a whole, the highest annual rate since 1990. While that should have been demoralizing enough for a Fed that was keeping QE on full blast just a handful of months ago because it believed that inflation was a transitory base effect that would end the year around 2-3%, the real devil was in the details. Without even a bit of exaggeration, this is among the hottest goods inflation prints on record.

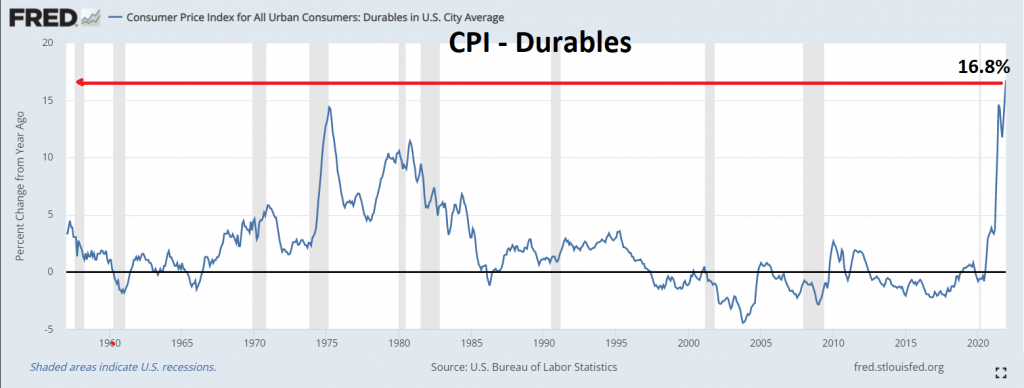

Durable goods inflation has officially hit its highest pace on record. Yes, durable goods inflation is higher than at any point in the 1970s.

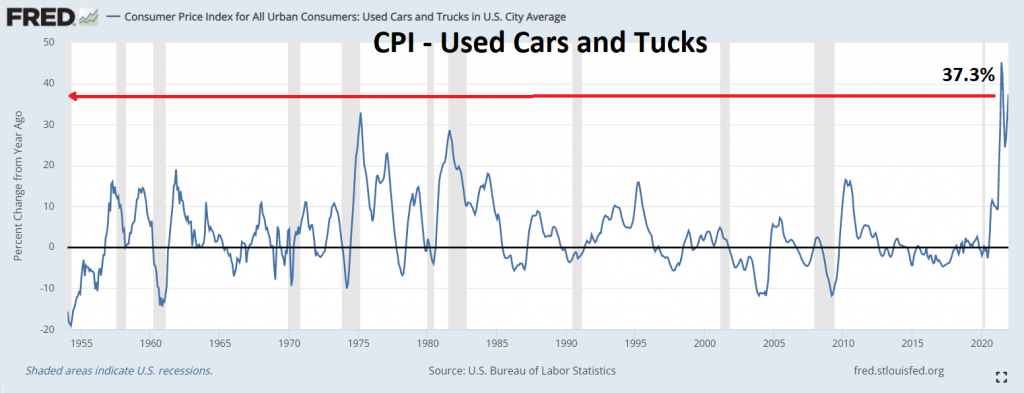

Used car CPI is currently running at 37% year-over-year, no small feat considering it was running at 10% year-over-year last December.

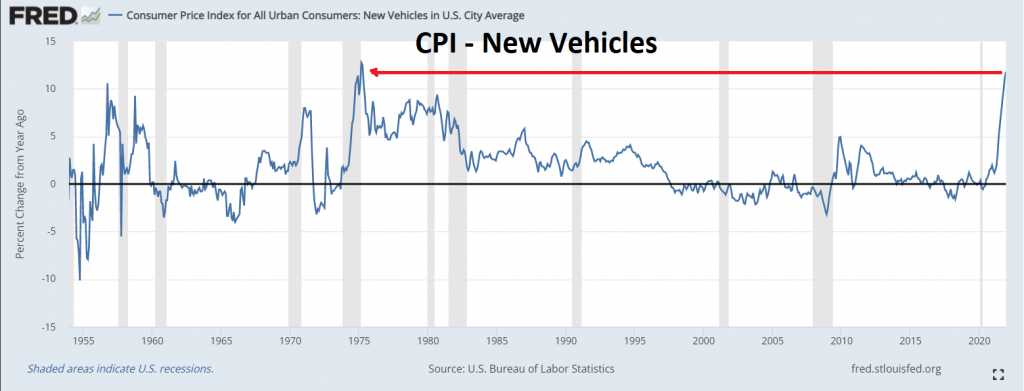

New Car CPI is currently running at 11.7%, the highest on record barring two months in early 1975.

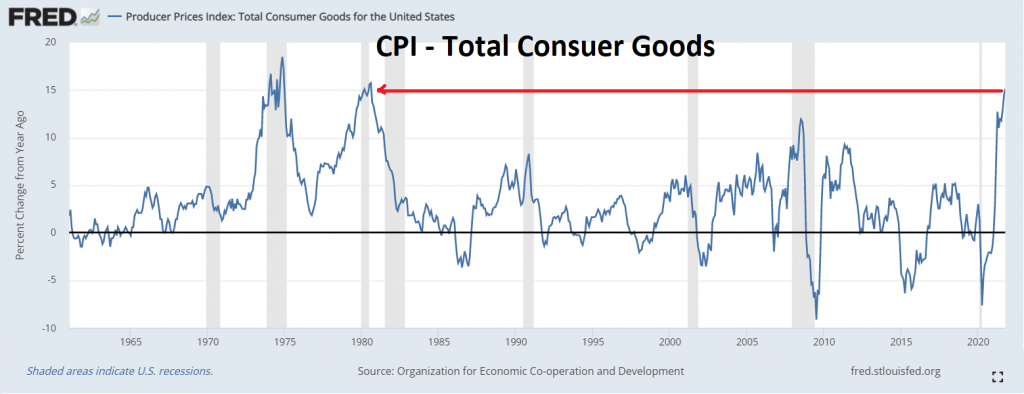

CPI for all consumer goods has only been higher in 1974 and a couple months in 1979-1980..

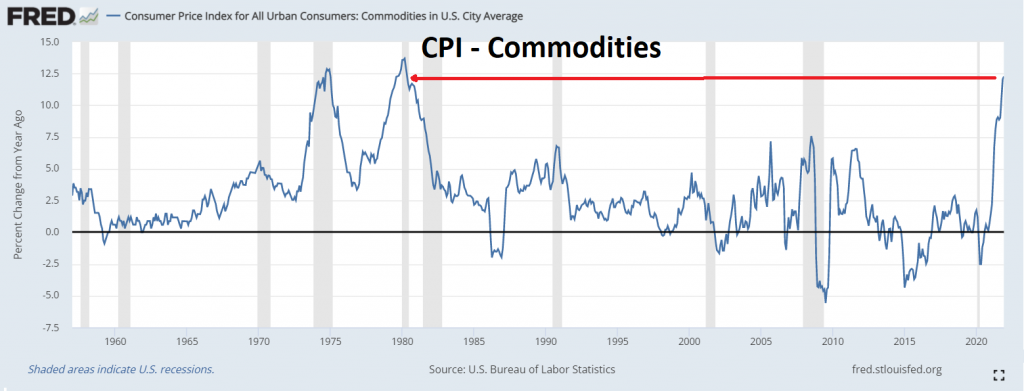

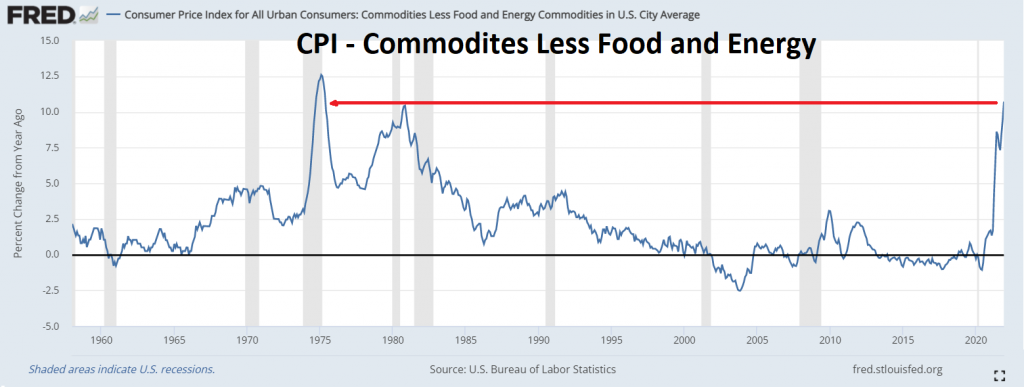

CPI for commodities is the highest on record except for a handful of months in 1974 and 1979 and commodity inflation less food and energy is the highest on record except for eight months in 1974-1975.

For anyone keeping track, the Fed Funds rate is still zero and the Fed is going to do about $60 billion of QE this month.

The Fed probably doesn’t realize it yet, but it is in the midst of an existential crisis. Settled are the tedious debates about how printing trillions of dollars and handing it out to people was not going to cause inflation. The question now is how the Fed could have missed so many signs last Winter, Spring, Summer, and Fall that inflation was going to overshoot (here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, etc…)

Presumably, inflation is going to peak in the next few months but it’s not like it’s going to turn negative. Consumers will never regain the purchasing power they have lost. To the contrary, we will continue to lose purchasing power, probably well in excess of 2% a year, but perhaps not at the accelerating pace were seeing now.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Either FED is stupid or lying because they have their back against the wall

lying is most obvious

don’t get upset.

instead, just this knowledge to your own financial benefit