Taps Coogan – February 13th, 2022

Enjoy The Sounding Line? Click here to subscribe for free.

Enjoy The Sounding Line? Click here to subscribe for free.

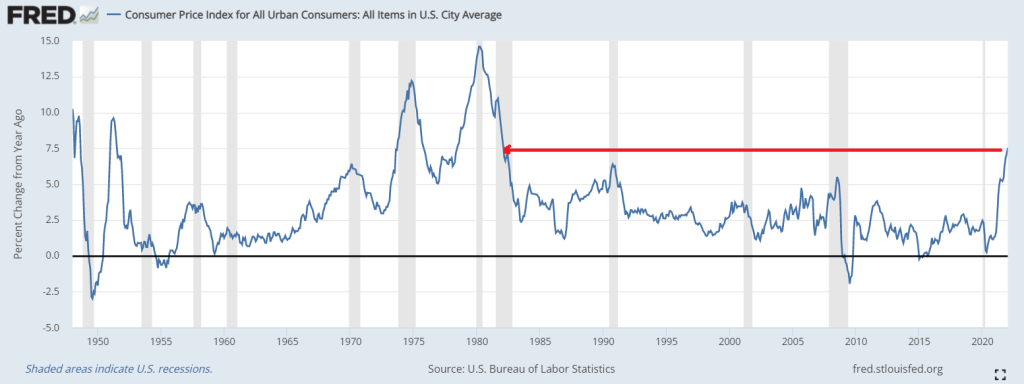

It has been nearly a year since headline CPI first eclipsed 2%, yet somehow we find ourselves with the Fed planning another $30 billion of QE this month – the tail end of its largest QE program ever, and the Fed Funds rate still stuck at the zero bound as inflation continues to grind higher, having now surpassed 7.5%, the highest rate since Paul Volcker was battling inflation in 1982.

The Fed has made a generational policy mistake.

Despite an endless parade of indicators starting in late 2020 that inflation was going to overshoot and remain persistent until the Fed did something about it (here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, here, etc…), the Fed and the Treasury were droning on about base effects and transitory factors until late last Fall.

The Fed’s policy stance over the past year is inconsistent with the notion of a data-driven Fed, or even a Fed that believes that its policy effects inflation, and makes the universal dovish bias of the institution highly conspicuous. There has not been a single dissenting vote on a major policy decision since at least 2012, only occasional dissents on bank regulations and the such, a stunning fact given that 2% inflation targeting has only been an official policy of the Fed since 2012. What’s the point of having a dozen FOMC seats if everyone always agrees with each other, even on radical new policies like quantitative easing, zero interest rate policy, and helicopter money?

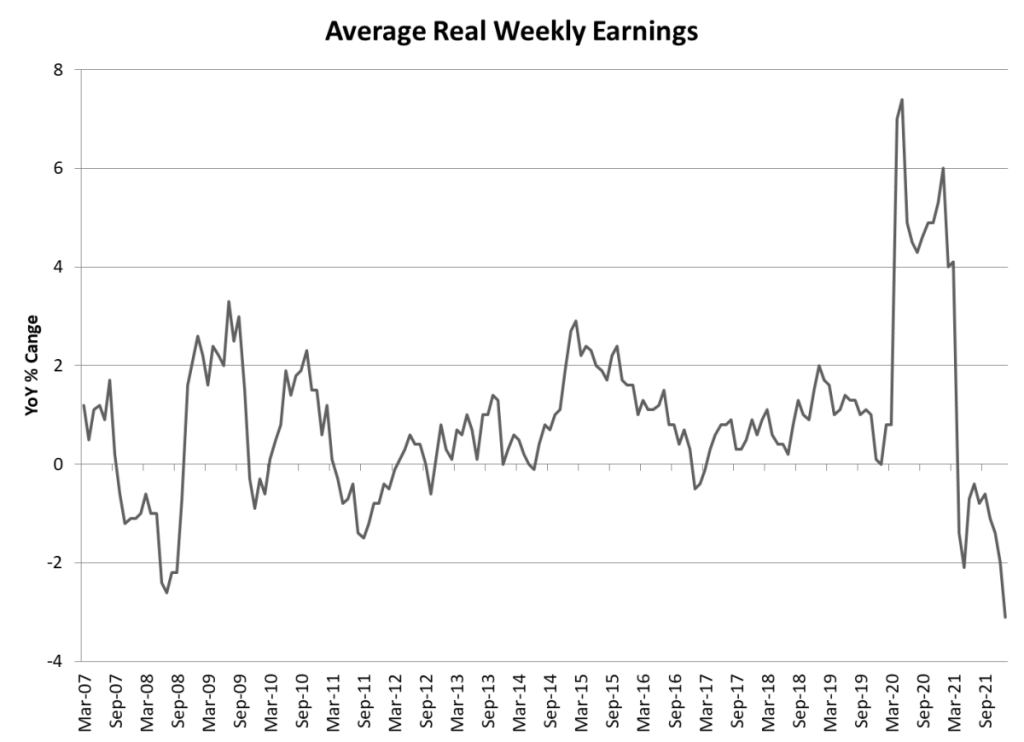

Why does any of this matter? Real wage growth has fallen so negative that it’s below where it was during the Global Financial Crisis, as the following chart from David Goldman at Asia Times highlights. It’s at this moment that the Fed now wants to slam on the brakes.

The gravity of the chart above cannot be overstated. The Fed missed its window to tighten policy and now, as workers suffer the recession like consequences of that mistake, the Fed will add to their misery by rushing to raise rates, risking stock market calamity and economic slowdown.

Putting aside the broader ideological debates about the Fed as an institution, fundamental questions of competency and biases are now unavoidable.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

Would you like to be notified when we publish a new article on The Sounding Line? Click here to subscribe for free.

What if it is not a “mistake”? What if it is the intentional execution of a plan? A plan which was avoidable and immoral, but one which allowed TPTB to continue their opiate to the masses staying power.

Well, that plan wouldn’t be looking very clever at this point